A Robot as Real Estate investment expert

Motivation

Most of the people you will deal with when looking to buy a house have the incentive that you buy. Meanwhile, your friends and family, those who might give you unbiased advice, might not be competent to advise you on this.

Selecting a house as investment always takes time, and there is huge value in finding your sources of information. While real estate investing is for many an art, facts and figures can be gathered that will tell you what kind of return to expect. I had a look at rentfaxpro.

This web service allows its (registered) users to search for properties and run comprehensive numbers against them.

Information

Service provides data that are available from other sites, aggregates them and uses them to produce income and expense estimates.

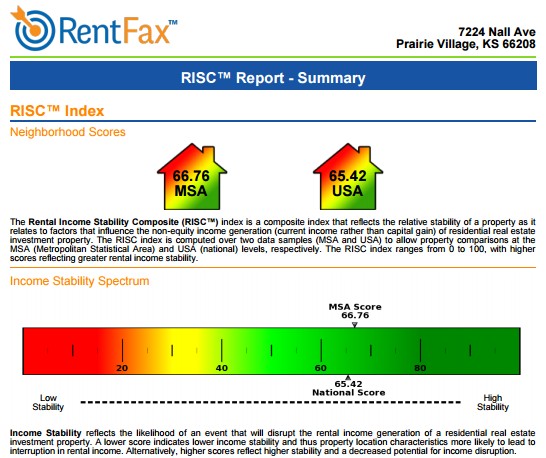

Property Risk

- population and density (important for rental property)

- house value and appreciation rates

- crime

- school quality

- property risk score (the score aggregates the above information, it appears that the creator of the score ranks properties with a score below 25 as property that have very serious risks)

Income

- market rent range

- tenancy vacancy length

- tenancy duration (the latter is seldom mentioned but very important when the property manager charges a full month of rent to find a new tenant)

Expenses

- property management (service gives the usual management rate nationally, and automatically assigns the most likely management rate for the property)

- tax (numbers appear accurate across a broad range of properties)

- insurance (numbers seem accurate for a high deductible insurance, except for Florida properties, unless one accepts a storm exclusion).

Net Income

- annual simulations are run in order to compute the most likely range of net income.

Application to a real-world portfolio

The rentfaxpro service was run across a portfolio of properties whose operation we supervise since 2014.

Properties were purchased every year since 2014. We observe a clear correlation between risk score and gross yield. While it was possible to get a gross rental yield of 12% in an area with a risk score of 35 to 50, the appreciation in these area (which now yield 9% to 10% gross) and good performance of the portfolio in the recent years has led the owner to seek higher gross yields and higher appreciation potential: properties with 14% gross yield were purchased with risk index around 25 or with 18% gross yield with risk index as low as 18.

For the income package, we will go through what worked and what could be improved:

- predicted rent range estimates were accurate (compared to comp provided by rentometer or even real estate agent) for most properties

- predicted tenancy duration was between 18 and 24 months. We much less turnover since we operate the properties. This might be due to economic tailwind helping keep the properties affordable for the tenants. We would need much more time to verify the accuracy of these numbers

- predicted expenses (taxes, insurance, and property manager) were accurate for all properties. One problem was that Florida properties insurance premium suggested Hurricane damage would be excluded (one may go for a very large deductible instead).

The risk index allows the prospective buyer to map a property to a given yield he would require given its risk level. One of the strengths of rentfaxpro is that it not only allows a prospective buyer to assess risk but it also enables a buyer to check the most likely net yield, which is what matters when comparing different properties.

Risk Scores and required rental yields

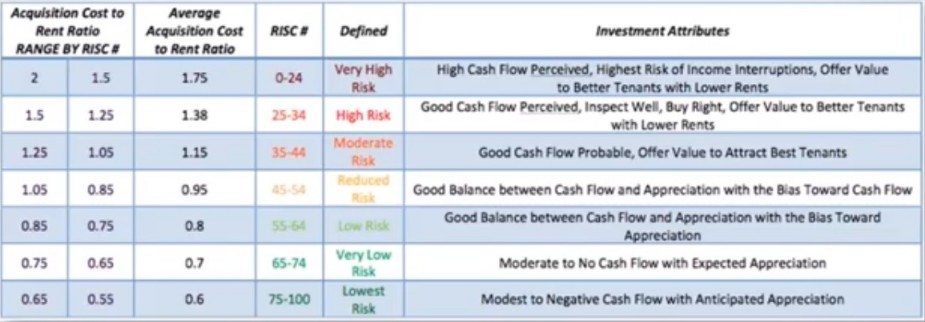

The founders of rentfaxpro have a wealth of experience in real estate investment. It is their opinion that property scores do map to property and tenant profiles and that rental growth yield should cover the additional risk of buying properties in struggling neighborhoods:

The "acquisition cost to rent ratio" corresponds to the formula monthly_rent/cost*100, and is, therefore, a more precise version of the "1% rule" (the rule that consists in dividing monthly rent by cost to determine if the property will produce cash flow):

(source: rentfaxpro. Disclaimer: data may differ significantly from actual performance experienced by landlords)

Here is a 53 minutes video about rentfax.

| Tweet |

| |

| Click here to share this on BiggerPockets.com! | ||