2007 - 2017: from Great Recession to Great Recovery

Goal of this article

Zillow index now has almost 10 years of data, so that we can follow asset price drop and into what asset pool all that printed money trickled down.

The data we look at does not allow us forecast whether liquidity and credit conditions will enable further price gains and continuation of the trends outlined here.

The world 10 years ago

The world of real estate 10 years ago was a very different place. The economic situation in July 2007 was well summed up by Jim Cramer Bernanke wake up call video here. Cramer was famous for his hyperbolic style, but the following course of event showed that Crammer was not overreacting. Bernanke had to, and did eventually wake up.

Stock Market: largest drawdown but now the biggest winner

For reference, here is what the stock market did: it went down 70% from the 2007 top in 2009, and then recovered 4x that value, and therefore increased more than any real estate over this period.

With its large 70% drawdown and following x4 performance, the stock market appears to be the ultimate canari in the coal mine when it comes to measure changes in liquidity availability.

With its large 70% drawdown and following x4 performance, the stock market appears to be the ultimate canari in the coal mine when it comes to measure changes in liquidity availability.

Real Estate 1: some Notorious Winners

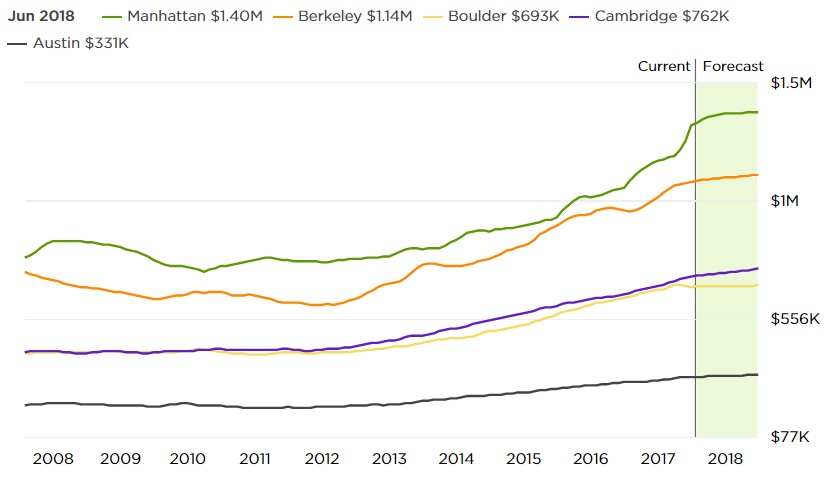

The only thing that performed nearly as well as stocks was Manhattan real estate.

These are the winner of the real estate appreciation game: these market did not drop at all, or not much, and appreciated by 50%:

Cambridge MA, Boulder CO and Austin TX are noteworthy for their remarkable resilience throughout the crisis.

Cambridge MA, Boulder CO and Austin TX are noteworthy for their remarkable resilience throughout the crisis.

Real Estate 2: some Pseudo Winners

These markets went up a lot since 2011, but make no mistake: the homeowner who bought before the crisis are poorer in nomial terms. Atlanta market is a bit different in that it took longer to take a dive, and is slightly up compared to before the crisis.

Some of these markets had very good rental yield once price went below replacement cost, and a rental yield above 10% would very nicely supplement capital appreciation.

| Tweet |

| |

| Click here to share this on BiggerPockets.com! | ||