Best Dynamic Cities in France

Case for investing in French Real Estate

You can see my earlier article on the pitfalls of French property investment here. In a nutshell, the two problems are:

- unfurnished rentals and their confiscatory taxation,

- rent controlled zones

The case for investing in France compared to the US:

- the low mortgage rates below 2% compare favorably to US mortgage above 5%.

- similar deductions on furnished rentals in France as unfurnished rentals in the US.

- relatively low prices due to high tax on standard unfurnished rentals.

Financing is required in France in order to achieve a net IRR above 6%.

To succeed as a landlord in France, you need to invest in properties that easily can be rented furnished. See my blog article on the fiscal treatment of furnished rentals here. You need a dynamic metropolitan area, and a gross yield above 6%.

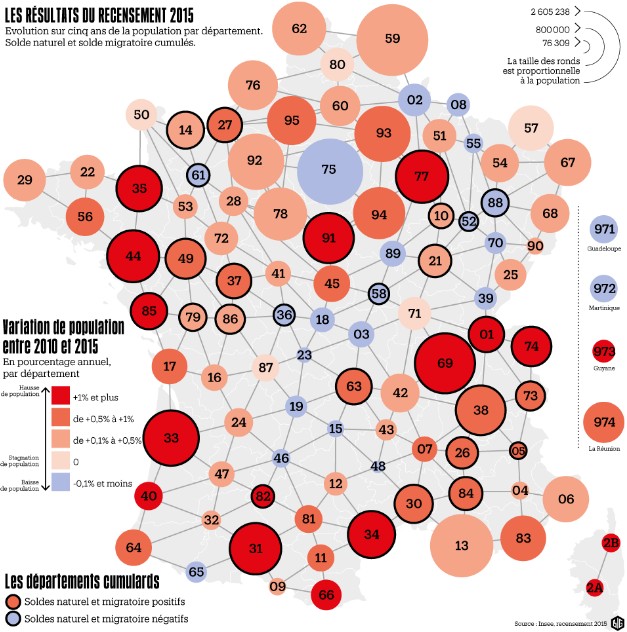

Census Results

The following census results published by Liberation, a French newspaper, show the most dynamics departments in France outside Paris:

- 01 Bourg en Bresse (Swiss border play)

- 31 Toulouse (Zone Tendue)

- 33 Bordeaux (Zone Tendue)

- 34 Montpellier (Zone Tendue)

- 35 Rennes

- 44 Nantes (Zone Tendue)

- 69 Lyon (Zone Tendue)

- 74 St Julien en Genevois/Annemasse (Swiss border play, Zone Tendue)

- 77 Melun (Zone Tendue)

- 91 Evry (Zone Tendue)

once we cross-reference this with rent controlled cities, we see that only Rennes is not rent controlled.

Image credit: liberation

Dynamic City of Rennes

Rennes is the capital of Brittany, its demography seems to increase by only 0-0.5% per year, which is nothing like the 3% growth of a successful US city.

Rennes highest yield for conventional furnished flat is achieved with a studio, this costs EUR 84,000 and returns EUR 440 per month, which means 5.3% to 6.6% gross yield, 2.8% to 3.3% cap rate (EBITDA yield) which can then be levered with a mortgage.

As the net yield of 3% is above the current mortgage rate of 1.8% at 25 years, a 25 year mortgage can be used to leverage this return of to an IRR just below 7% for a LTV (Loan To Value) of 100%, the monthly mortgage repayments are negative in this case. The LTV needs to be lower (at 80%) for the investment to be cashflow neutral.

Swiss Border City of Saint Julien en Genevois or Annemasse

This city borders with Geneve had its population double since 1970 to 34k. Doubling over a 50 year period means that population growth has been below 2%, which is healthy by French standards.

The studio flats rent for $500 with a similar investment return.

| Tweet |

| |

| Click here to share this on BiggerPockets.com! | ||