Zillow Research 18Q4: Gentrification Endgame

Zillow Research has published its latest quarterly report on the US market.

Long Term Price Evolution

- National home price appreciation has been between 5% and 8%, with depression at -10% during the crisis years since 2000.

- National median rental increase stayed between 0% and 3% since 2011, there was a peak at 6% in 2015.

Rents are less volatile and increased lower in the past 20 years. This is because a low yield environment has made a temporary decoupling between rent variation and price variation possible.

Market Evolution since Last Year

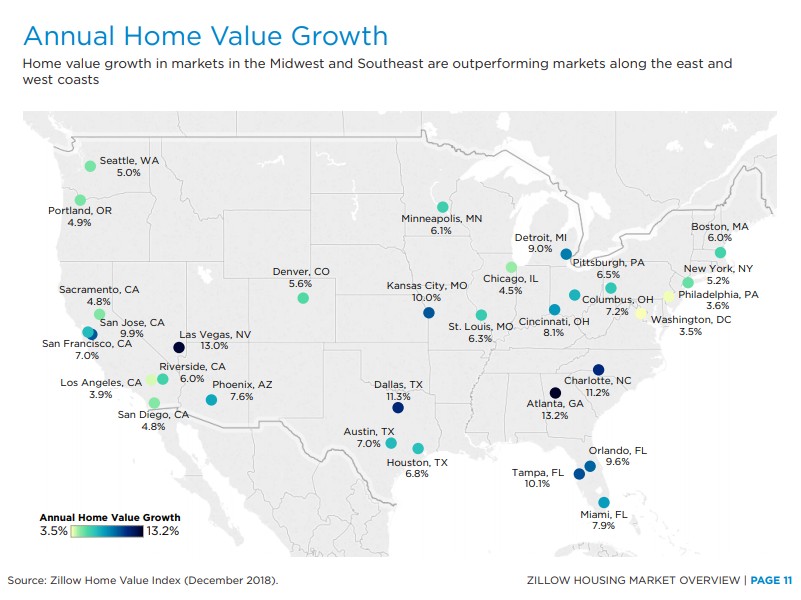

- Geographically, areas with price highest appreciations are the cheapest: with Boston, Dallas, Detroit, Atlanta above 7.6% and Phoenix, Washington, Los Angeles seeing tepid below 3.3% growth. (see p13)

- Growth differential is even larger by market category: bottom 3rd homes increase by 9.9% whereas the top third see a price increase of only 4.7% (see p15)

This is a lame year for price appreciation. The lower-priced property are catching up.

Rent Evolution and Affordability

- rent growth is much slower than price growth, at 1.4% nationally, with very few hotspots.

- on a nationwide average level, buying cost 17% of income and renting costs 28%, these numbers are both well below the affordability threshold of 30% and within 4% of 40Y long term average. If anything, buying seems to be more affordable at a national level.

image credit: Zillow

I take the better affordability of buying comparatively to rent to be indicative of:

- much lower mortgage rates than rental yields

- disparities between buyers who have a good credit score and lower-income Americans who do not have access to credit.

Affordability for the bottom third of Americans is deteriorating faster than for the other cohorts. The fact that the bottom third house price rise much faster than the rest spells the name of the game:

We are witnessing a gentrification endgame.

This is what typically happens last in an appreciating market, so it appears that we are approaching the end of the bull.

| Tweet |

| |

| Click here to share this on BiggerPockets.com! | ||