Zillow 19Q4: Gentrification Trend Continues

New Data from Zillow

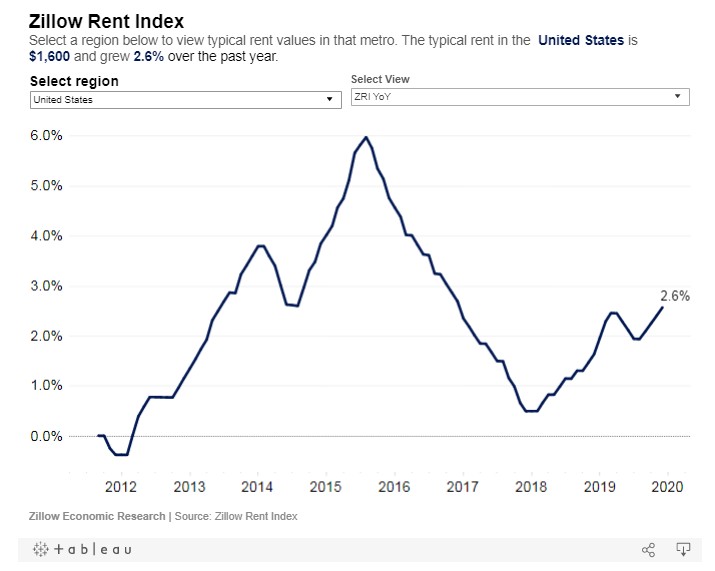

We already discussed here in 2018. We see now that Zillow 2019 Q4 data shows a continuation of the trend of house prices and rents:

- House prices are appreciating at 4.4% in the bottom tier 2.5% for top tier:

- house rents now increase, but they are increasing slower at 2.6%

Impact of Financing on Affordability

As explained here on a previous post about affordability, that prices grow faster than rents at the national level can be explained by rents being constrained by income, whereas purchases can be financed by debt that is cheaper to service given ever lower interest.

Our view it that there is room for further appreciation as US rates go lower.

The Winners keep on Winning

Another theme apparent when playing with the tableau report to check various MSA is that recovery is very dependent of the location. The winners of 10 years ago keep on winning faster than the losers recover: Vegas plunged from 300k to 120k during the GFC and did not recovery yet, whereas Charlotte and Indianapolis had little depreciation and much appreciation.

It is remarkable that less risky areas appreciate more. The Matthew Effect does apply for US real estate.

| Tweet |

| |

| Click here to share this on BiggerPockets.com! | ||