Are you Overpaying for Dwelling Property Insurance?

Here are a few notes on obtaining dwelling insurance in the US. Property insurance is one of the main property operating expense along with local taxes and property management. Here are a few notes on insurance in the US.

Insurance Market Standards

We first review common practice on the insurance market. This will give you a feel of how much you are supposed to pay for insurance.

Insurance Cost

Homeowners pay $1,000 per year in insurance on average. The average differ by state, but Florida ($2,000) and Texas, Louisiana ($1,800) and Oklahoma ($1,600) stand out as the 4 states where insurance cost is indeed much different from other states. For example, FL premium are the same as in other states, but a massive add-on for named storms is added to the policy.

Liability and Peril

Liability insurance covers you in case someone sues you over some claim they have against you that arises out of your rental activity (most likely someone suing the owner for an injury linked to the building). Peril insurance covers you for damage to the property.

Types of contract

Most common Dwelling Property insurance contracts are the dp2 (liability and named perils) and dp3 (liability and all perils unless explicitly excluded). The dp3 is better as it is all encompassing.

The standard cover generally uses as low as $1000 deductible, and insure full replacement value. Higher deductible such as $2500 or $5000. Standard coinsurance is 80%, but can be increased to 100% to lower the bill. However, while the insurance company is always willing to lower the expected value potential claims payoff, it can be reluctant to fully translate these lower expected payoff into lower premium.

Insurance Company

The following are traditional companies, which can be reached through state specific brokers:

- State Farm

- Allstate

- Liberty Mutual

- Farmers Insurance

- USAA Insurance

- Travelers Companies

- Nationwide Mutual

- American Family Insurance

- Chubb

- Erie Insurance

Investor policies can also be obtained where each policy can be paid by month. Lloyd's underwrites such insurance.

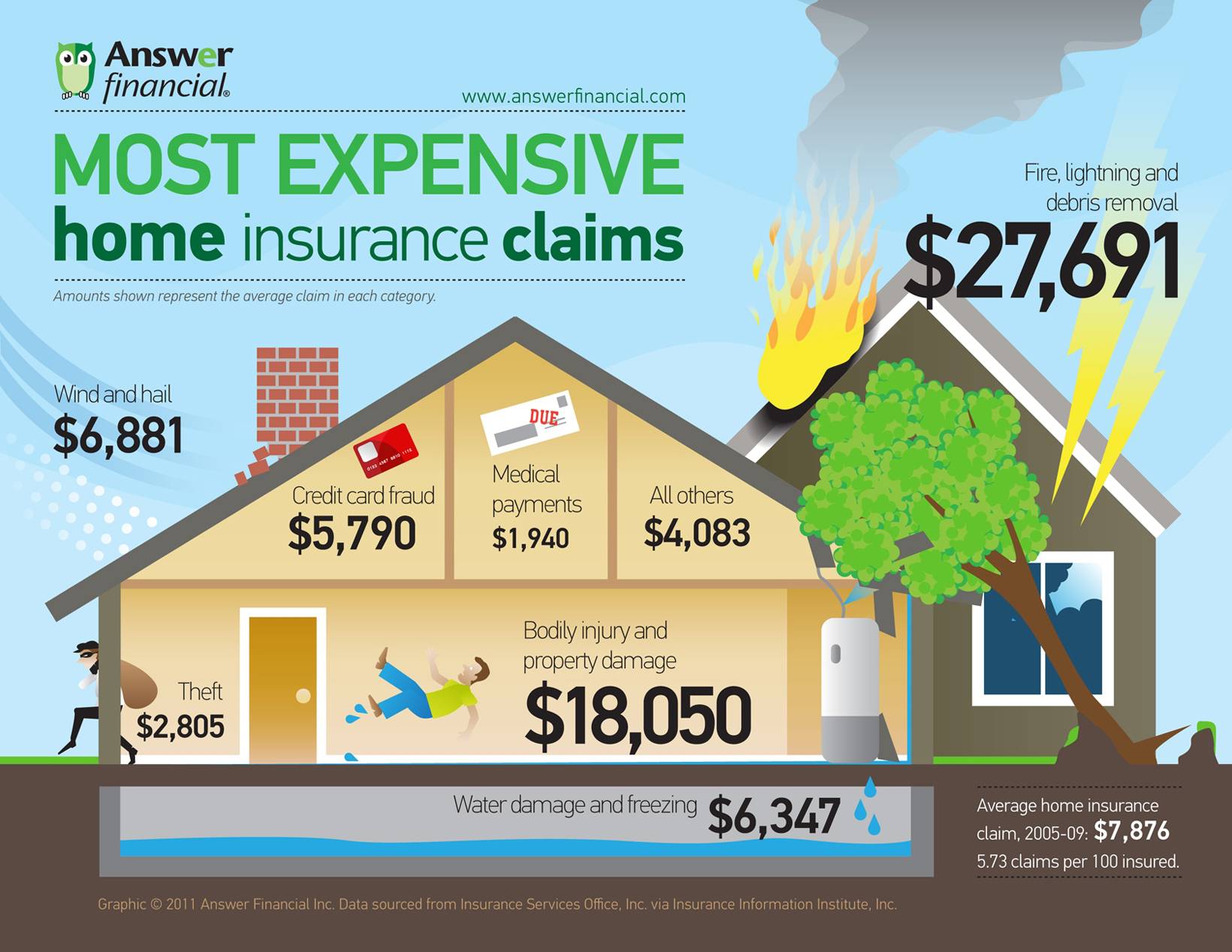

What are the odds? Loss severity and frequency

we collect a few facts from the iii (insurance information institute).

Similar information are available in graphic format from answerfinancial.com

Loss frequency comes around 7% (from 5% to 10% depending on the year) and average severity is $9,000, though the most important insurance payoffs are the much higher ones that avoid ruin.

Liability insurance will protect you from lawsuit, the probability of such a claim is 0.15% per year, and the average severity is $15,000. Liability suits have no upper limits, but insurance companies do impose a limit, and it is wise in any case to have your properties held by an LLC.

Peril insurance will protect losses that have a frequency of 5% to 10% per year and an average severity of $9,000. The most severe losses come from fire and lightning, at $34,000 with a very low probability of 0.34%. Still this category accounts for 25% of insured losses. Then comes wind and hail damage, which at $8,000 corresponds to the average of small claims and homeowners that wait for hail to get their roof replaced and paid for by the insurance company, this is 10 times more frequent, at 3.5% per year frequency and represents between 27% and 45% of insurance claims. Then comes water dammage, with a similar average severity but lower than 2% frequency, causing

Good insurance should be priced fairly, the insurance companies make most money from people who purchase insurance without understanding their contract.

Advanced Policy Terms

Deductible

Assuming a house is adequately insured, the reimbursement upon a claim will be

payout = max(damage - deductible, 0)

It is recommended not to file a claim if it is to near the deductible, as it will show in the property claim history and impact future insurance premium. Increasing the deductible leads to a lower premium. Saving should be compared in the number of years during which no claim needs to be filed, as insurance do not reward or penalize you fairly (compared to expected payout change) for changing your deductible.

Value Insured and Coinsurance: Replacement Value and Cash Value

You are responsible for the insured value you chose to insure. Coinsurance of replacement value works as follow: if you insure a property for $100,000 and it turns out to cost $150,000 to replace, not only is your insurance paying you only $100,000 in case of total loss, but if the kitchen burns down and causes $30,000 of damage to the property, the insurance will pay for a claim of only $20,000, and they will remove the deductible from that much smaller amount.

The least favorable coinsurance rate you can get is 100% (means you are at risk as soon as insured value is below replacement value). Coinsurance rate of 80% will make this adjustment more lenient as it kicks in only if insured value is below 80% of the replacement value determined at the time of the claim.

- rv = replacement value

- iv = insured value

- c = coinsurance rate

- d=deductible

- loss = damage repair cost

- payout = max(min(min(ic/(c x rv),1) x loss, iv) - d, 0)

If you insure at cash value, the amount insured will be replacement value minus some depreciation, which means that you might not get anything in case a 25 year old roof is damaged by hail, whereas a new roof would be insured.

It seems that the best course of action is to obtain adequate cover and find the "sweet spot" at which cover is achieved on the most efficient terms.

The Elusive Replacement Value

You may obtain wildly different replacement values from different brokers. The risk is to either overpay, or have insufficient cover (as an insurance adjuster will determine a more precise replacement value at the time of a claim). The replacement value should be compared to the price per sqf, anything below $70/sqf is very low, anything above $100/sqf is very high.

I quote my insurance broker on how replacement cost is commonly computed by him:

We utilize two different systems to compute your replacement cost values, Value 360, E2Value and Marshall Swift. Those are the three leading providers of replacement cost technology. While those programs are designed exactly for that purpose, they can be wrong, which is why I always recommend 90% or 80% coinsurance. The reason for 3 different programs is insurers use different programs, so we make sure to match the program we estimate the value with the program they will use to estimate the value at claim time.

Agreed Valued Endorsement

I will quote Mike Flavin's post on the biggerpockets forum: insurance companies require you to insure your rental property at the cost to replace. They do this because they know if they used market value every investor would claim a value lower than the actual value knowing that most claims are not total losses of the property. To prevent this they charge a penalty if you are insured for less than their required amount of insurance.

As john stated most companies allow you to choose from 100% 90% and 80%. Your insurance rate will be lower the higher percentage you choose. Standard is 80% is rate x 1 90% is rate x .95 and 100% is rate x.9. The insurance adjuster will determine the replacement cost at the time of a claim so lying about the characteristics of your building doesn't do any good.

The best way to get around this issue is the agreed value endorsement. With agreed value you and the insurance company sign a document at the beginning of each policy period stating you both agree on a certain value upfront and that will be considered 100% coinsurance in the event of a claim. If you are considered a quality risk the insurance company will often set the agreed value of as the cost of rebuilding with the most basic materials and appliances. (i.e siding, carpet, linoleum, etc.) In Missouri 90 cents a square foot is a common valuation. REMEMBER if your entire building is destroyed you will only be given the agreed value regardless of the actual cost to rebuild.

Its important to note that insurance companies will not do agreed value unless you are considered a "good risk". A good risk is someone unlikely to file claims and will only file claims for large unpreventable accidents. I have found the main ways you can be considered a good risk are:

- Well Maintained Roofs: The biggest reason property insurance has increased over the past decade is because of people who let their roofs deteriorate until a hail storm and then have insurance pay for their new roofs.

- Proactive Maintenance Plan: If you are routinely fixing small issues when they appear they are less likely to turn into bigger issues.

- Written Risk Management Policy: Deadbolt locks and alarm systems, tenant screening, not letting units go below freezing in winter, not allowing grills on balconies, etc.

- High Deductible: If you are doing steps 1-3 you are very unlikely to have incidents resulting in smaller claims. Having a high deductible is a way to put your money where your mouth is and show you have confidence in your property.

- Good Claims History: Historic results are the best way to predict future results. Insurance companies look at frequency not severity.

| Tweet |

| |

| Click here to share this on BiggerPockets.com! | ||