Financial Analysis of Mortgages

Motivation

Financial analysis is a dry subject, and some motivation for the following is in order. The following sections will allow to answer the following questions:

- what is the impact of financing on profitability, how much quicker can you double your money with it?

- what is the cost of interests and how is it affected by mortgage term and rate

- what difference does principal repayment make in the affordability of the mortgage.

As a picture is worth a thousand words, we illustrate this discussion with carefully designed figures. The pictures are not as simple as one would wish as both term and interest rate are relevant. You may skip this rather arid section on your first reading. The relations exposed below are abstract, but they only need to be learned once.

Impact of Financing on Profitability

You capacity to find financing is the second most important factor affecting the profitability of your real estate investment, the first factor is the net yield, also called capitalization rate, or return on asset. Financing at a lower APR than the yield will allow you to buy more asset with less equity, and get an improved return on equity. What is key here is not that financing allows you to make larger investment, but that financing be at a much lower rate than the property net yield to enhance the investment profitability.

If we denote L the leverage, y the cap rate, and m the margin of safety between cap rate and mortgage interest, the internal rate of return (irr) is given by:

irr = y + (leverage-1) x m

As a rule from a profitability standpoint, you should consider the longest possible mortgage if there is a significant margin due to a big difference between property cap rate and mortgage rate, the mortgage won't help the profitability if that margin is small.

As the interests paid are tax deductible, it is the interest rate reduced by your marginal tax bracket that should be used in the computation if you are going to make a net profit. We would call this the net mortgage rate, as it is net of the tax deduction you can make. If you are going to make a loss, the gross mortgage rate is what you would consider for your calculation.

When borrowing to buy a principal residence, banks may lend up to 95% of the price (that's a leverage of 20), because they trust that you can work and generate income from your work. They would typically look for an income coverage ratio of the mortgage payment above 30%, to ensure that it is affordable compared to your income. So you can pay your way out of trouble.

If you contemplate a much larger investment based solely on the income it generates, and you can't bail your property out in case of a net loss, such a high leverage is not feasible. A leverage over x1.5 is actually adventurous in such cases. It should be noted that once you have several properties.

a possibility is to start with a 80% LTV mortgage when you have another source of stable income, and lower the leverage as you increase your real estate exposure.

Cost of debt service

While mortgage rate determines your investment profitability, the payments you need to make on a standard mortgage are higher than interest. The principal needs to be reimbursed as well.

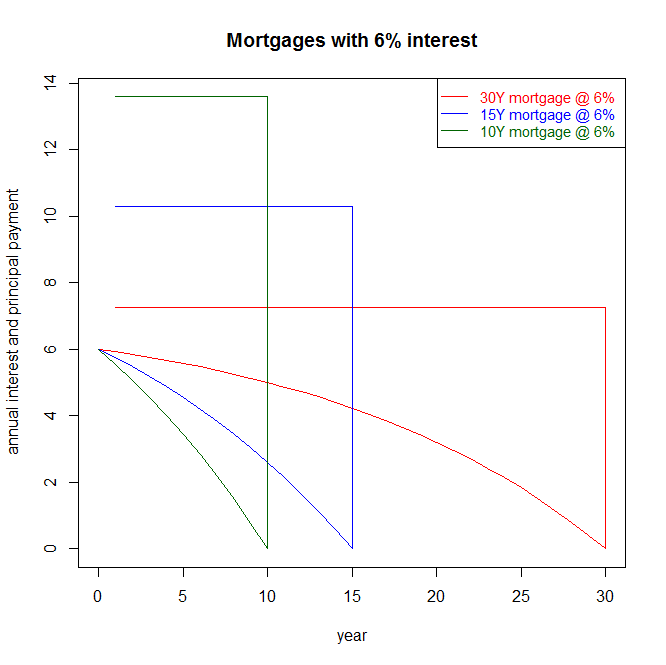

We give here a mathematical analysis of the cost of interest for various maturities and rates level. We show the portion of the constant annuity payments actually constitute interest:

.

.

Interest cost are significant on 30Y mortgage with rates at or above 6%: whereas interest cost is much lower for a 10Y mortgage. Note however, that the portion of interest paid on a 30Y mortgage moves also a lot with interest rates, from 33% with 2% rates, to 218% with 10% rate.

For this reason, many advise to buy with a 10Y mortgage to minimise borrowing cost. This makes sense for a home occupier, who may choose a more frugal home, and for whom the interest payment is like paying a rent to his lender. A bigger mortgage helps you to buy a more expensive house, which if you overdo it gives you more rooms than you needed, and more indebtedness.

For an investor, mortgage interest paid if it is lower than the net yield of the property is helping to finance more properties. When each property generates more income than the mortgage interest rate, indebtedness is increasing the profitability.

Assuming the rates offered for 10Y and 30Y are the same, if we just consider profitability, it is advisable to choose the longest mortgage term possible and with a loan to value such that the property produces as little free cashflow as possible.

Impact of Financing on Solvency

There is no point being profitable if you are not solvent. You also need to consider cashflow.

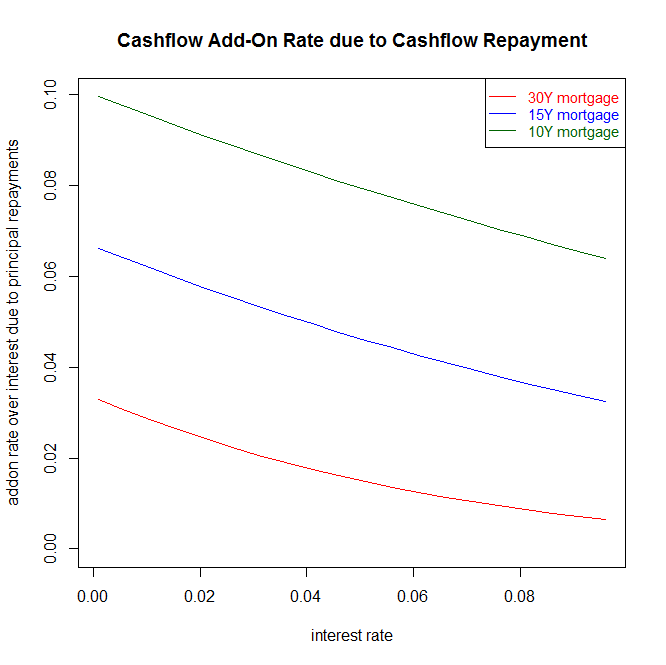

We give here a mathematical analysis of the additional cashflow burden caused by principal repayments. Repaying the principal of the mortgages grosses up the annual payments by only 1% to 2% higher over interest amount if the mortgage is repaid in 30Y with a rate between 4% and 6%. However, the addon due to principal repayment will be around 8% for a mortgage repaid in 10Y.

We now show how much of additional cashflow is due to principal repayments:

From a solvency point of view however, having most cashflow used for spending and debt servicing means that there is little margin of safety. Whereas considerations of profitability drive the decision to take the longest mortgage or none at all, considerations of solvency would lead to reduce the size of the mortgage if he is unsure to be able to meet repayments.

There is a balancing act between staying solvent by making the mortgage longer to have repayment cashflows as small as possible, and being profitable by lowering interest charge and speeding up the repayment so as to not overpay interest.