US Real Estate Investor Setup

Here is a typical setup for people who invest in US real estate to get rental income. The material is intended to give a synthetic overview of the US rental market, and what are the relevant points to consider.

- Case for US Real Estate Investment

- Types of Residential Properties

- Profitability and Solvency

- Practical Aspects of Home Buying

- Types of Mortgages

- Financial Analysis of Mortgage

- Overview of US Rental Property Taxation

- Tax Consideration Specific to Foreigners

- Legal Entity for Ownership

- About the author

I am a foreign investor myself, this content relates to my personal experience as an investor in the US.

The case for US Real Estate Investment

The mortgage crisis in 2007 and ensuing financial breakdown caused massive destruction of asset values between 2007 and 2009. US homeowners who had overextended themselves with mortgage and home equity loans had their property foreclosed. High foreclosures rates combined with the lenders sudden tightening of lending standards to create a perfect storm. This led to severely depressed real estate prices.

While prices remained high in hip areas such as Manhattan and San Francisco, a firesale was on for most parts of the US. From Phoenix to Florida, from Texas to Michigan investors saw net yields in their teens whereas treasury yield went near 0.

Many houses traded at a severe discount compared to the value measured by building replacement value. This means that buying recent or new houses could be done for less than what it had cost the developer to build a new house. This happened not only in rust belt cities where population has been decreasing since the 50's such as Buffalo (NY), Cleveland (OH) or Detroit (MI), but also in growing areas where the secular demographic trend has caused population to increase over decades. Over-development in sunbelt states such as Nevada, Florida and Georgia caused prices there to fall precipitously.

This is a unique opportunity for investors. Here is a country whose law enshrines property rights that guarantee that the house will stay yours, where income and capital gains taxes are low and even lower for non resident foreigners, where the market is the most transparent thanks to websites such as Zillow and Trulia, where every property can be inspected with google streetview, where free appraisals online and where an independent professional property inspector can check a house for defect for $300, and email you the detailed report with pictures before you make your choice. And now, this country has the most affordable homes in the world, and the highest differential between rental yield and mortgage rates.

When such fundamentally low prices are available, property selection and management execution do not need to be excellent. The investment is given so much of a tailwind that the general outcome is success. There are serious caveats to this, but you should do fine unless you as over borrowing or getting into shady deals.

Different type of properties are suited to different business strategy depending on whether the investor rental income or capital gains. I propose the following 4 profiles in increasing order of rental yield. You will be able to identify the kind of property you are dealing with based on their rental yield.

Types of US Residential Properties

Different type of properties are suited to different business strategy depending on whether the investor rental income or capital gains. I propose the following 4 profiles in increasing order of rental yield. You will be able to identify the kind of property you are dealing with based on their rental yield.

Pricey Fashionable Areas

Here is an example: a 3 bedroom in Cambridge (MA) is currently up to rent for $2400 per month while its value is estimated at 1.4mln. In this case an owner accepts a gross yield of 2% only in exchange for the pride and privilege of owning a house near Harvard and MIT far beyond what is to be rationally expected to be the rent collected on this home.

Prime and exclusive locations are expensive not because those areas are particularly nice, the reasons are invariably social. Some areas have a brand that is associated with success. People will buy that brand so that they can signal their success by owning an overpriced houses, and meet other successful people. While this social reinforcement mechanism is similar to that of a bubble, prices in these area are very resilient. Prices did not go down in Manhattan in 2009, although this is biggest financial crisis ever, and the only instance of nationwide real estate downturns ever. This tells a lot about the solvency of these owners. Transaction volumes do slow down, but there are less foreclosures in these cities than anywhere else in the US and the prices remained high. In fact, such properties appear to be most safe in case of downturn. This does not mean that these houses are necessarily a great investment, while house prices are likely to keep up with inflation, whereas people investing in houses with 10% higher yield will double their money every 7 years.

Parallel to that influx of success seeking individuals, properties with multi-million prices experience a drain from people cashing out on their house and leaving for cheaper place. If the proud owner of this 3 bedroom Cambridge house paid of his mortgage by the time he retires, he might consider using the money to buy a nice $300k house with everything he wants, and use the extra $1.1mln to generate $11k of gross monthly rental income. While short term prices are safest in areas such as Cambridge, buying there at current prices requires the belief that the best society will continue to choose this place to congregate.

In area where nice houses can be bought for $300k or $400k, there should be no problem for the price increase to continue given the demographic tailwind.

Investing for Capital Gain

Here is a typical example: in Cary (NC), a 2200 sqf home 4 bed 4 bath home, with hardwood floors, granite counter tops, fireplace, stainless appliances, in a nice leafy suburban location.

The house would rent for an estimated $1900 per month and thus return 7% gross. Most people who can afford this will see that the mortgage would cost only $1200 per month. Unless there are special circumstances, we can expect the occupier to buy in that area instead of renting.

A capital gain property will typically appeal to mass affluent home buyers. The school district is an important indicator of the neighborhood quality. You target buyers does not care how much the house would rent for, they want a fireplace, hardwood floors, a kitchen with granite counter tops and stainless appliances, and all the fashionable fixtures that would invite invidious comparison. The HOA will be expected to offer convenient sport facilities and swimming pool. This property will be anything but frugal.

A common strategy for real estate professionals in the US is to fix and flip. Typically, the house is purchased at a 30% discount to its potential value, say less than 10% of the price is spent on improving the property, which is then sold within 6 month leaving a 20% profit in 6 month. Getting the estimates right and the work done on time and on budget involves working on such deals full time. A less lucky investor will find that the property is harder to sell than anticipated, and the investor is stuck with a house that can neither be sold or rented for a profit.

There are many areas where indeed, buying only makes sense for capital gain. One would think about many up and coming areas of the of the US, such as the Cary (NC), Austin (TX), Portland (OR) or Gilbert (AZ). In these areas, houses have already gone beyond what rental investors can offer, due to an influx of affluent home buyers who will buy with low mortgage rates at such prices for lifestyle reasons.

Home appreciation has been very unevenly distributed in the US. Real estate professional normally consider short term deals that close within 3 to 6 month. Buying for long term appreciation requires an understanding of what long term changes are occurring in an area.

Investing for Rental Income

Here is a typical example: a house built after 1980 with very basic fixture: carpet floors, linoleum floor in bathrooms may be found for 90k-140k in an area where it pays $900-$1400 per month. The house will not have the formidable qualities of the capital gain house, but its price is so low that nothing much can go wrong with it. The rent can compensate depreciation.

With a median annual salary of $51000, rents lower than $1400 are affordable for the majority of the US population. At such prices, it is possible to find investments with with month rent at 1% of the property price (that's 12% gross yield).

Investing for rental income is easier than for gain, as one just needs to find a property with an affordable rent, in an area with a healthy job market to be able rent it, there is no need to find a property below market price as in the capital gain business model.

At $900-$1400 per month, most tenants rent by choice as they could save to buy a better house. Perhaps they do not want to deal with calling contractors for home emergencies. Such safe income properties in this price range make sense when annual rent is 10%-12% of the property price.

High Cashflow Investments

Here is an example: wooden frame house build in the 70's, selling for $35k and rented $650 per month.

You should be aware that there is a qualitative gap in tenant sociological category when rents are lower than $900 per month. When you buy a property value below 90k, this is far below the replacement value of most houses and implies that the house is not generally desirable (it might be too ancient or in a bad neighborhood). At such prices, you see an increasing number of tenant who struggle through life, even if they pay the rent, they may have too many problems to take good care of the property they live in.

The term of trashflow property is the colloquiallism for such houses sold below $70k with yields above 14%. While houses between 70k and 90k value would be crossover between trashflow and cashflow properties. These investments are the most profitable of all when all works well, but with higher yields come higher risks. Anything paying more than 12% will require an exceptional property manager to keep the rent coming, you need to be monitor your property manager carefully if you get into that business. You will also need to consider whether the state has landlord friendly or tenant friendly laws, and buy such houses through a LLC to avoid big problems.

Profitability and Solvency

What drives house fundamental value

The previous made a sociological description of the varied types of home dwellers in the US and their motivation. We will now concern ourselves with real estate as an investment and review some of the fundamental driver of home value.

- Inflation: the Shiller study of house prices show the national level US house value in inflation adjusted terms along with its building costs. Over the long term, house prices are stable in inflation adjusted terms, and their value seems to follow the general level of consumer prices. Since 2000 however, we observe a decoupling between national house prices and inflation. This graph aggregates very different numbers together, as some areas have houses trading much nearer their building cost, while in others, land value is socially or speculatively enhanced. The bottom line is that one should not expect house prices to appreciate faster than inflation. This being said, owning a house instead of cash always makes sense in a context where central banks are printing money. Houses are excellent hyperinflation hedges.

- Demographics: some areas will appreciate faster than others. Demographic changes occur over very long periods of over 30 years. For instance, the population of Chicago (IL) decreased from 3.6mln in 1950 to 2.6mln. For Detroit (MI), it went from 1.8mln in 1950 to 700k today. The population of these cities decreased steadily every 10 years for more than 60 years. In each of these city, sufficient dwelling for 1mln people has become vacant, high quality brick houses are now available below replacement cost. For house prices to rise again, the population needs to increase again so that we go from housing glut to scarcity again. Cities such as Austin TX where population grew 15% to 40% every 10 year saw much faster home value growth. You can find demographics in the wikipedia section of any city.

- Depreciation and costs: while long term house prices appear to follow inflation, a house built in 1900 would need to have its plumbing updated from lead pipe to copper, electricity installed, etc. If the house has a wooden frame, the house needs to be demolished and rebuilt after some time. The taxman asks you to assume that the house value will depreciate for 27.5 years, and you should indeed expect some depreciation if you buy and hold a house in an area where the population is not increasing.

- Rent: as suggested by Shiller, buying a very expensive home and hoping that it appreciates over time does not make sense in many locations: you can only hope to breakeven with inflation if population is stable or even worse than that if it decreases over the long term. Besides, you need to add in the cost of maintaining the house, and this may well cost you 3% to 4% per year. The game changer here is that if you receive a high rent compared to the house expenses, this effect may more than compensate the others. So buying an expensive home may be a poor investment, but buying many reasonably priced rental properties has much better economics.

Houses are good inflation hedges. Markets can be capricious and there is significant risk in holding real estate for a few years. Capital gains are a source of profit, but an unreliable one. Rental yield is a measure of house fundamental value, and that yield allows one to compare this investment with bonds or stocks.

Similar to gold bullions, houses are good inflation hedges, and their short term price move is subject to animal spirits. Unlike gold bullions, houses are dynamic investment that generate income and costs. We will next look at rental as a business activity and define of net income.

Net Income

When viewed as a rental business, an income statement from the activity can be written with the following elements:

- gross income comes from rents and any other receipts (coin operated laundry...)

- operating expenses corresponds to insurance, fees, repairs, management fees, home office costs

- interest from mortgage and credit card need to be deducted

- depreciation from improvements and property that have a life above 12 month need to be deducted, although they can be amortized over the life of the improvement.

- net income = gross income - expenses - interest and depreciation

If spending is categorized as operational expense, it is fully deductible from income for that year, if it is categorized as a capital expenditure (e.g. if it is an improvement rather than a repair) it needs to be depreciated, which means that the deduction will occur over the life of the expenditure.

We'll review this definition in the section about tax, as net income is what the IRS uses to determine rental income.

Profitability and Solvency Measures

The following section deals with finance computation. Going through this will enable you to do the comparative analysis of investments, to know which one is safer, and which one will double your money faster. You might want to skip this section if you are not in a mood for learning difficult (but rewarding) concepts. It is a dry topic that requires focus, so you may skip this section and return to it when you are ready for a more technical read.

It is one thing to compare the investment potential of similar properties, it is another to get the right metrics to compare investments. You need to know in absolute terms how well your investment is supposed to make.

The following measures will help you determine the intrinsic profitability or a real estate investment. To keep the formulae simple and straigthforward, all the income and expense numbers should be annual, and a yield calculation giving 0.05 means 5%, a yield of 0.11 gives 11% to avoid seeing factors 100 show up at multiple places in every formula.

- gross yield=gross income/price: this is the gross annual rent. This tells you how much your gross receipts from the properties are in the best case. Note that the actual gross yield will be much lower if the rental is left vacant. One generally includes a statistically realistic estimate for vacancy, but each year will have a different vacancy rate. The gross yield is generally in the 10%-14% range for profitable cashflow properties.

- expense rate=expenses/price: where expenses correspond to annual expenses for the property. You would expect some money on repairs, local property tax, insurance, management, and any other expense that are commonly deductible. Depending on area, you can expect (0.5%-3%) property tax, 0.5%-1.5% insurance, 1% management cost. Repairs will be anywhere between 0%-1% on good years, 2% on less luck years. This means an expense ratio of 3%-6% for the property. You should look for properties with low fixed expense ratio, as having high expense will make your situation difficult if the gross income is lower than anticipated due to vacancy.

- capitalisation rate=gross yield-expense rate: This number gives you the intrinsic profitability of the property, independent of the financing you choose. As a yield net of expenses, it also tells you what is the margin of safety of the property as an investment. Capitalisation rate measures how this investment value grows if the property is bought cash. The income net of expenses is also called ebitda (earning before interest tax and depreciation), and the cap rate is also called the ebitda yield of the rental activity.

The following measures take into account the leverage that financing gives you:

- Loan To value Ratio (LTV)=(mortgage principal)/price is the number showing how big the loan is compared to the investment.

- leverage=price/(price-mortgage principal)=1/(1+LTV) is the number showing how much leverage the mortgage is allowing for your investment. A mortgage with a LTV (Loan To Value) ratio of 0.95 gives you a leverage of 20, LTV=0.8 gives you a leverage of 5, LTV=0.5 gives you a leverage of 2, while purchasing cash LTV=0 results in leverage=1.

- cash on cash rate=leverage x (gross income-expenses-mortgage pmt)/price. This measure shows you how much cash flow will be generated by your investment given the amount of cash invested initially. This will linked to the cap rate as follow: cash on cash = leverage x (cap rate-interest rate-addon repayment rate). The addon repayment rate is dependent on mortgage term and interest rate, it is 1/NbYear when rates are 0, but lower when rates increase. For 30Y, the addon repayment rate will go down from 2% to 1.25% for rates in the 3%-7% range. This is a solvency ratio.

- irr (internal rate of return)=leverage x (gross income-expenses-mortgage interest)/price. This measure the leveraged net investment yield without taking into account the mortgage principal repayments. It will be linked to cap rate by irr=leverage x (cap rate-mortgage rate). This number shows how the financing you obtained in increasing the property profitability. The difference with the cash on cash rates is the mortgage add-on rate, and this number shows the true profitability of the investment, and should be used for relative value computation.

Note that the last 2 rates include the effect of financing in the profitability computation. They involve a leverage multiplier which is applied to both gross income and expenses. The higher the leverage, the bigger the difference between pro-forma irr and actual irr. You will find that gross rate and cap rate are relatively stable estimates, while cash on cash and irr are much more uncertain given the leverage.

One more element is needed to understand how the tax authorities view your property income: the depreciation. The IRS considers that a real estate property has a useful life of 27.5Y, which means that 3.6% of the property value can be deducted every year. The depreciation applies to the house but not to the land, in case the house is estimated to be worth 0.8 the total property price, the depreciation is 0.8 times 3.6% or 2.9%.

- depreciation rate=(building value)/(building+land value)/27.5. The irr net of depreciation would be irr=leverage x(cap rate-mortgage rate-depreciation rate)

Houses have been around for hundreds of years. Since most of them were either fully rebuilt, or have undergone major renovations of their plumbing and electrical installation in the last 50 years, some owners must have paid for these. While the optimist will assume they can sell the property at an appreciated price, there are large repairs and improvements that you will need to pay if the property is kept for a long time.

You will need to refresh the property and update it to standards every 15 or 30 years. So having a long term reserve set aside for such work makes sense.

If you invest in a property that has good demographic trends, and prices compare favorably with replacement value, you might decide that the IRS is too pessimistic and it would be more realistic to include an appreciation rate than a depreciation. On the other hand, it is most likely that properties with yield above 12% will not appreciate as they usually only appeal to high yield investor.

We finish with a last measure:

- taxable net yield=cap rate-LTV x interest rate-depreciation rate.

Whatever your assumptions to compute appreciation/depreciation for the property, your investment income will be taxed at your marginal tax bracket rate computed on the net taxable yield, which is the cap rate, net of mortgage interest if any and depreciation rate. For a property that with a 80% LTV mortgage at 5%, the interest deduction will be 4% and the depreciation deduction will be a further 2.6%. That means that the first 6.6% income from the cap rate are not taxable, and the rest is taxed at your marginal rate.

## Practical Aspects of Home Buying

Cost of Buying or Selling a Property

How much will it cost to buy or sell a property? You can expect the following:

- real estate agent commission: 6% this is included in the price, but you should be mindful that the seller has to pay these fees. If you take a buyer's agent, buyer and seller agent will split the commission 3%-3%.

- title search insurance and other legal fees: $2000-$3000

- home inspection fee: $300

- appraisal and mortgage origination would cost around $1500

Property Search

Where do you want to search for a property? If you search in the area where you live, you might get faster access to information, seeing a house directly helps you quickly understand whether this house is for you, and you can make an offer earlier than other investors. The question is how much of an edge do you get by being local?

A skilled home buyer with superior local information can hope to pay 5% to 10% less for a house in any given location. It is unlikely however, that he would get to buy houses with more discount that this if the house is in tenant ready condition. If the buyer lives next to the property, he might be able to manage the property himself, and that would avoid his paying 10% of gross rent as a fee to a professional property manager.

However, some areas in the US yield much more than others. While it is easy to get 10% rental yield near Atlanta (GA), there is no way to get anywhere near that in San Francisco (CA).

The traditional way to search for a property consists in organizing a meeting with an estate agent, describe to him what you are looking for, after which he will let you visit properties that he believes correspond to what you search. This process is very time consuming both for you and for the agent, and restricts your property search.

Visiting in person is the best to feel the vibe and the soul of an area, and it makes sense for a home or a vacation home where you want to live. However, when it comes to making a rental investment decision, it should come next after making sure the property financials are aligned with your objectives.

A more modern way to do this is to consult online resources such as zillow, trulia which cover all the houses in the US. This will give you a precise idea of how much houses sell and rent for in any area. You can also feel the vibe and soul of the area by checking the crime map on Trulia (and see whether crimes are parking tickets or gangs shooting at police) as well as the school map, which will show you the quality of the school districts.

After that, you can contact a few local estate agents (through zillow for instance), sending them a standard text that you arranged to describe what kind of property you would be looking at, and when you would be buying. You can then talk to one or a few agents and select one you wish to work with for that area. (You should be transparent with the agent on the fact you are looking for an agent in the area, and then select one who will do the search for you). Agents should be able to advise you on the best online resource for the location. For instance, zillow or trulia listings can be a few weeks old in some areas, so that another website is more up to date).

Some agents contacted by email will never answer you call (they are not motivated) while some others will definitely be more friendly. After the first conversation with them, you might ask them if they can advise a mortgage broker, a property manager and an insurance broker in that area. That should be easy for them and professionals usually like to be referred to each other. This will greatly help you get started when you find a good house.

Again, if you speak to 4 or 5 estate agents, they will introduce you to 4 or 5 mortgage brokers and you will have a good idea of what financing you can get, and what your budget is. Understanding what financing you can get must the first step in your buying real estate.

Once you selected one estate agent, he should be able to give you access to a personalised search on the Multiple Listing Service (MLS). The MLS is an online resource that contains the most up to date and most accurate information on what properties are available and what comparables have sold for. MLS access is available to real estate professional for a fee, so they will give you access for as long as the search is on with them.

If some properties are of interest to you, discuss them with your estate agent, he has a lot of local knowledge and will help you understand your investment, as well as advise you as to what price an offer can be made on a given property.

Buying Process

Before making an offer, you need either a proof of fund from your bank, or a pre-approval mortgage letter. So knowing the finance situation is a prerequisite.

The estate agent profession is regulated in the US. A person must be licensed as an agent and follow the regulation if he is to sell other's people homes. The typical forms that the agent will ask you to sign are standard forms issued by the state's board of realtor.

The estate agent should be able to discuss options with you, the offer will come with an earnest money deposit of a few thousands that you can get back if you change your mind within a time period described in the contract.

if you make an offer conditional on inspection, you will be able to request that the seller does repairs on warrantied items found during inspection or ask for money. The seller may require you to make an offer as is, in which case you do not have the option to lower the price after inspection, but you can still walk away should the inspection turn out any problem.

A most important point is the time you are allowed to have the inspection organised, and decide whether or not to walk away. You cannot allow that deadline to pass without decision as you would loose your earnest money for no reason, since you can always obtain that the seller agrees and signs for an extension.

While a real estate agent will give you a sales talk, and possibly some important market information, a good home inspection report will help you understand the quality of the construction. The inspector will notice any minor building code infractions, and while they may not amount to much, this helps you understand whether the builder knew what he was doing, and what you should expect in terms of durability.

Rehab

Buying a houses that is not in tenantable condition is a great way to obtain a property at an improved price. However, if fix and flipper are very active in a given area, it becomes likely that the only deals that are left are looser once the cost of repairs is taken into account. Buying for rehab is a much more complex operation than buying an already tenant ready property. It adds the complexity of finding suitable contractors and checking their work.

For this reason, it is not usually advisable to buy for rehab for an out of state investor.

Management

Before buying a house, you need to find a suitable management arrangement. If you cannot manage the property, property managers normally keep $600 to $1000 in reserve in case of emergency, charge between 8% and 10% of gross rent, and may charge a month of rent as tenant finding fee.

Small to medium property managers should have 3 to 4 full time employees managing the properties or doing accounts for 200 to 400 properties under management. Having this critical mass is necessary to ensure that the manager is experienced and can deal with emergency, and to ensure that there is enough income for someone to be paid to be there to answer the phone.

You should also check how serious the property manager is: what kind of monthly report does he send, how easy does he make it for the tenants to use wire the money rather than wait for checks in the post, whether he uses credit reports to screen tenants. A good manager will have the ability to select and retain good tenants, ensuring low vacancy for your properties. A bad manager will struggle to keep tenants, and will also struggle to find new ones for your property resulting in high vacancy. Vacancy is the nemesis of your rental property profitability.

Some tenants are very easy to manage while some others will be constantly having problems. The latter will cost you money and will cost your manager time. Your manager should be experienced with managing similar homes to the one you have, and you should ask him about that. This experience will help him to appropriately screen the tenants. His interest in this is totally aligned to yours, he wants tenants who never complain of anything and keep paying.

Finally, some property managers will propose contracts with much higher fees (11%, 12%) and substantial contract renewal fees for tenants who stay year after year. You should be able to negotiate those away, as those are not reasonable terms.

Turnkey Provider

Turnkey providers are real estate companies engaged in the process of buying, rehabbing, selling and managing properties for investors. The provide a turnkey solution to the investing problem. They generally look at properties marketed below $200,000 since prices above that would be more for fix and flippers who want to sell to home owner.

Compared to a solution where you need to study a real estate market to find better yield properties, filter out the properties that need some rehab, and find management suitable for that property, turnkey provider can enable you to access a property market.

Most turnkey provider are honest companies that can identify properties that would be appealing to renters after rehab, and are looking to sell these to a rental investor at a competitive price, the property management can leverage on their particular understanding of a tenant market segment, and can result in much lower vacancy and much higher yield. Therefore, turnkey provider should definitely be considered.

Turnkey provider do not need to be registered real estate agents if they own the properties they sell. This means that the contract they ask you to sign can be based on the state's realtor board forms or can be completely free form. In the latter case, you need to make sure there is a provision for you to walk away in case the inspection done after the renovation is not satisfactory to you. You should also make sure that the contract terms allow for time for the rehab to be completed, and some weeks to carry out the inspection. Some contracts are drafted in a way that they do not seem to allow this, but you can always agree with the providers on the insertion of reasonable terms, and then add them manually.

There are however a few warning signs you should consider: some providers charge prices far above market price for the properties, or else they ask for management fees at 12% instead of 10%. Finally, some providers have terrible feedback from dissatisfied customer online. Everything except integrity is negotiable, so you can always obtain better terms from your provider, but you need to be careful to see who you get to work with.

Types of Mortgages

We give below an overview of financing options for buy and hold real estate investors.

Conforming Mortgages: The Best Deal in Town

For those who qualify, the so called conforming mortgage might well be the best game in town in terms of low rates and low risks. Such mortgages last for 30 years with a very competitive low fixed rate. They can even be paid back early in case the owner wants to refinance when rates go down.

As bank liabilities have much shorter term, there is significant systemic risk for banks in lending people at fixed rates on such long maturities. Letting borrowers refinance at any time gives further increases the risk, where the lender stands to loose a lot if rates go up, and not gain at all if rates go down.

For the purpose of helping owners get much better deals on their mortgages without bankrupting the banks, the US government sponsored agencies (GSE) that buy back conforming mortgages from banks and have come to dominate the mortgage market.

Those agency policies are ultimately controlled by politicians. In an impressive display of bipartisan consensus, republican President H W Bush signed the Housing and Community Development Act of 1992, the Democratic Congress' view that the GSEs "have an affirmative obligation to facilitate the financing of affordable housing for low- and moderate-income families in a manner consistent with their overall public purposes, while maintaining a strong financial condition and a reasonable economic return."

For this reason, GSE compliant mortgages provide unbeatable rates and conditions.

Portfolio Lending

If your investment does not comply with GSE conditions, you may still get financing. However, lender may offer lower LTV, and floating rate payments after a few fixed years. You may find a portfolio lender by speaking with several mortgage brokers, or investors with similar investments to the one you are looking at.

As a foreigner, I was able to obtain a 5.5% for 5Y (then floating) rate 30Y US based mortgage with 50% LTV. The question in that case is after 5Y, you may have to repay the mortgage because the rates have become much higher, this does significantly adds to your risk.

Collateralised Lending

Even when the investor has sufficient funds to purchase cash, it appears that a reasonable mortgage interest deduction (comparable to the deduction obtained by people who would use financing) can be generated by structuring the investment appropriately.

As a general rule however, you should not be able to deduct more than what an investor would deduct with financing at arm's length. The IRS created many rules intended to avoid abuse, and you may want to check your setup with a professional experienced on such matters.

Foreigners may pay mortgage such interest with no tax by taking advantage of portfolio interest provisions voted by congress or advantageous tax treaties with countries such as Ireland.

Financial Analysis of Mortgages

Motivation

Financial analysis is a dry subject, and some motivation for the following is in order. The following sections will allow to answer the following questions:

- what is the impact of financing on profitability, how much quicker can you double your money with it?

- what is the cost of interests and how is it affected by mortgage term and rate

- what difference does principal repayment make in the affordability of the mortgage.

As a picture is worth a thousand words, we illustrate this discussion with carefully designed figures. The pictures are not as simple as one would wish as both term and interest rate are relevant. You may skip this rather arid section on your first reading. The relations exposed below are abstract, but they only need to be learned once.

Impact of Financing on Profitability

You capacity to find financing is the second most important factor affecting the profitability of your real estate investment, the first factor is the net yield, also called capitalization rate, or return on asset. Financing at a lower APR than the yield will allow you to buy more asset with less equity, and get an improved return on equity. What is key here is not that financing allows you to make larger investment, but that financing be at a much lower rate than the property net yield to enhance the investment profitability.

If we denote L the leverage, y the cap rate, and m the margin of safety between cap rate and mortgage interest, the internal rate of return (irr) is given by:

irr = y + (leverage-1) x m

As a rule from a profitability standpoint, you should consider the longest possible mortgage if there is a significant margin due to a big difference between property cap rate and mortgage rate, the mortgage won't help the profitability if that margin is small.

As the interests paid are tax deductible, it is the interest rate reduced by your marginal tax bracket that should be used in the computation if you are going to make a net profit. We would call this the net mortgage rate, as it is net of the tax deduction you can make. If you are going to make a loss, the gross mortgage rate is what you would consider for your calculation.

When borrowing to buy a principal residence, banks may lend up to 95% of the price (that's a leverage of 20), because they trust that you can work and generate income from your work. They would typically look for an income coverage ratio of the mortgage payment above 30%, to ensure that it is affordable compared to your income. So you can pay your way out of trouble.

If you contemplate a much larger investment based solely on the income it generates, and you can't bail your property out in case of a net loss, such a high leverage is not feasible. A leverage over x1.5 is actually adventurous in such cases. It should be noted that once you have several properties.

a possibility is to start with a 80% LTV mortgage when you have another source of stable income, and lower the leverage as you increase your real estate exposure.

Cost of debt service

While mortgage rate determines your investment profitability, the payments you need to make on a standard mortgage are higher than interest. The principal needs to be reimbursed as well.

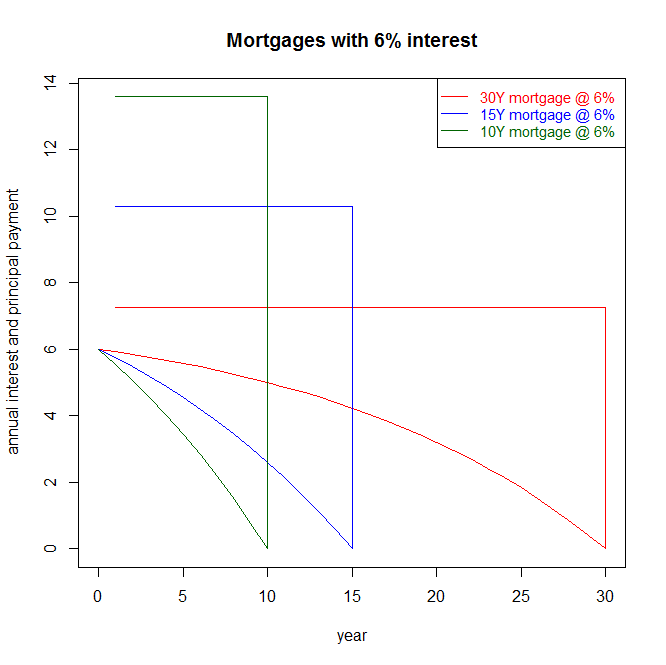

We give here a mathematical analysis of the cost of interest for various maturities and rates level. We show the portion of the constant annuity payments actually constitute interest:

.

.

Interest cost are significant on 30Y mortgage with rates at or above 6%: whereas interest cost is much lower for a 10Y mortgage. Note however, that the portion of interest paid on a 30Y mortgage moves also a lot with interest rates, from 33% with 2% rates, to 218% with 10% rate.

For this reason, many advise to buy with a 10Y mortgage to minimise borrowing cost. This makes sense for a home occupier, who may choose a more frugal home, and for whom the interest payment is like paying a rent to his lender. A bigger mortgage helps you to buy a more expensive house, which if you overdo it gives you more rooms than you needed, and more indebtedness.

For an investor, mortgage interest paid if it is lower than the net yield of the property is helping to finance more properties. When each property generates more income than the mortgage interest rate, indebtedness is increasing the profitability.

Assuming the rates offered for 10Y and 30Y are the same, if we just consider profitability, it is advisable to choose the longest mortgage term possible and with a loan to value such that the property produces as little free cashflow as possible.

Impact of Financing on Solvency

There is no point being profitable if you are not solvent. You also need to consider cashflow.

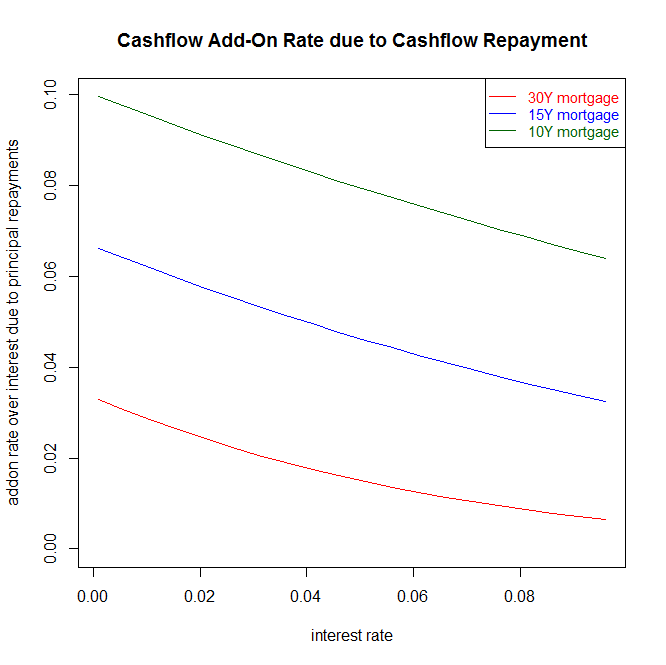

We give here a mathematical analysis of the additional cashflow burden caused by principal repayments. Repaying the principal of the mortgages grosses up the annual payments by only 1% to 2% higher over interest amount if the mortgage is repaid in 30Y with a rate between 4% and 6%. However, the addon due to principal repayment will be around 8% for a mortgage repaid in 10Y.

We now show how much of additional cashflow is due to principal repayments:

From a solvency point of view however, having most cashflow used for spending and debt servicing means that there is little margin of safety. Whereas considerations of profitability drive the decision to take the longest mortgage or none at all, considerations of solvency would lead to reduce the size of the mortgage if he is unsure to be able to meet repayments.

There is a balancing act between staying solvent by making the mortgage longer to have repayment cashflows as small as possible, and being profitable by lowering interest charge and speeding up the repayment so as to not overpay interest.

Overview of US Property Taxation

I give below a brief outline of the various property taxes: local and city taxes, federal income tax and state income tax, and finally capital gains tax.

Local Tax

Owners of real estate property in the US are subject to local taxes, independently on whether the property generates income or not. These taxes are generally based on the assessed value of the property. They vary widely depending on the state and county, with an observed range between 0.5% and 3% of value.

The tax bills are sent automatically to the registered owner of the property, and online payments options is generally available. Unlike incomes taxes, there is no need to file a specific return.

Note that a 3% tax typical in Texas on a property returning 10% a year brings down the after tax return to 7%. This would be equivalent to a 30% tax on gross income. This explains in part the large differences in rental yields between states as landlords generally pay less for an asset that comes with a large local tax liability.

Federal Income Tax

Property rental income from a US property is subject to federal taxation. The federal taxes are collected to the Inland Revenue Service (IRS). It should be noted that the IRS conveniently shifted the onus of collection to the taxpayer: he is responsible for determining whether he needs to file a tax return, for computing the tax and for sending payment for the amount computed.

Federal Income Tax Basis

Real estate activity is taxed as a business on its net income. The income statement from the activity is prepared and federal and state tax is computed from the profits.

- gross income comes from rents and any other receipts (coin operated laundry...)

- operating expenses corresponds to insurance, fees, repairs, management fees, home office costs

- interest from mortgage and credit card are also deductible

- depreciation from improvements and property that have a life above 12 month are also deductible.

- taxable income is net income = gross income - expenses - interest and depreciation

If spending is categorized as operational expense, it is fully deductible from income for that year, if it is categorized as a capital expenditure (e.g. if it is an improvement rather than a repair) it needs to be depreciated, which means that the deduction will occur over the life of the expenditure. There are many IRS rules dealing with deductions and expense categorization and amortization. Depreciation is subject to recapture for capital gain when the asset is sold, whether expenses are not.

The deductions allowed are substantial compared to the property gross yield: the deduction for interest expense and for building depreciation at a rate of 3.5% can reduce the gross yield by more than 7%. The management fees, repair, and other costs are all deductible.

Federal Income Tax Rate

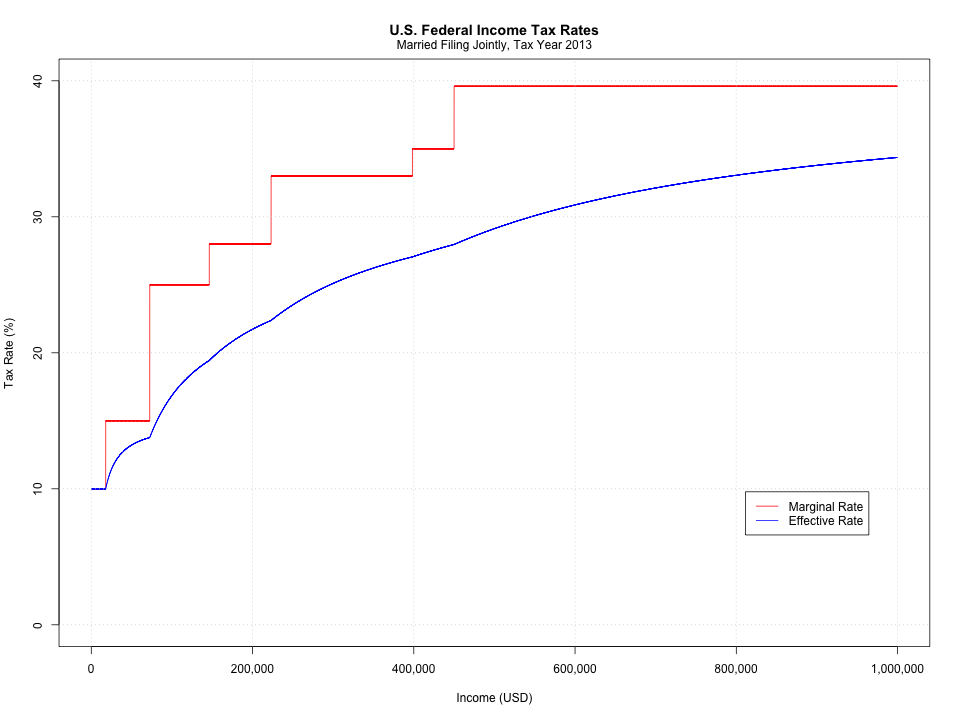

The property net income is then taxed at the taxpayer marginal rate, which goes typically from 0% for revenue below $4000 pear year to 39% for revenues above $400,000 per year. The marginal and effective federal tax rate are shown here. The effective and marginal federal income tax rates look as follow:

State Income Tax

State income tax computation requires that your federal income tax be first computed.

Rental property income gives rise to a state tax liability where the property is located requires. Nine states impose no state income tax, in this case, only local tax and federal taxes are due and no state tax return filing is necessary: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, Tennessee, New Hampshire. In any other state, you will need to file a state tax return based on the federal return, you can expect a tax rate between 0% and 5%. California and New York being egregious exceptions where state tax income can reach 12%. If you own properties in several states, you will need to determine the income or loss attributable to each state.

Capital Gains Tax

Capital gains tax is due when an investment property is sold at a profit. There are exemptions for houses where the taxpayer has lived continuously. Capital gains are declared on the income tax returns, in a special section as taxation is at a much lower rate.

- short term capital gain is taxed at level similars to ordinary income

- long term capital gains are taxed from 0 to 15% (with a 20% level for 39% marginal bracket taxpayers).

The rationale for the lower level of long term capital gains taxation is to encourage investment.

As a property was subject to a depreciation deduction, the depreciation is going to be taxed by the IRS if the property is sold above the depreciated value. This is called depreciation recapture.

Forms included in a real estate federal tax return

Federal tax filing in general is a complicated process. US Residents can use online software or hire an accountant. NRA can not file online, and tax preparation software cannot be bought outside the US. They can either fill the form by themselves or hire an accountant.

To help understand what tax filing looks like in practice, we'll introduce the main tax forms that need to be filled. For our purpose, at least three set of forms always need to submitted. These are, in top down order:

- main income tax form: form 1040 for resident 1040NR for non resident

- real estate net income computation: form 1040 schedule E

- house depreciation computation: form 4562

The state income tax depend on the state where the property is located. They refer to federal tax income forms, so it is necessary to filled federal forms first.

For filing the taxes, the depreciation form needs to be filled first, its result is an input in form 1040 schedule E which needs to be filled second. The form 1040NR is filled last. You can check the links to find explanations.

Additional forms that may apply

- The alternative minimum tax (AMT) is relevant for income that arises from activities that receive a favorable tax treatment. While residential rental activity does not give rise to AMT liability. I am not sure whether some capital gains may give rise to such liability, I would seek advise on this when I sell a property. See form 6251.

- If the net result from real estate operation is negative, the form 8532 needs to be used.

- capital gains declaration in case of sale: form 8949

Information Specific to Foreign Investors

A Non Resident Alien (NRA) owning property in the US pays local tax but still does not have to file an income tax return with the IRS. The default regime is 30% withholding of all gross payments. However, the taxpayer can elect for the same treatment as US taxpayers in which case tax are due on net income instead of gross income. This is called the election for Effectively Connected Income (ECI) treatment.

Classification of income into FDAP and ECI for Non Resident Alien

The IRS classifies income into two general categories:

- The Fixed,-Determinable,-Annual,-Periodical-(FDAP)-Income. This class of income is subject to a high flat tax rate. It does not allow for any netting of related expense, FDAP applies on stock dividends, bond coupons and US savings account interest.

- The Effectively-Connected-Income-(ECI)), meaning connected to some business or activity in the US. ECI is subject to gradual income tax on the basis of US based net income. The important difference it makes for investor is only taxed on Net Income.

The ECI treatment allows for deduction of all expenses related to the investment, including mortgage interests, local taxes, insurance, repairs, property management, etc. NRA who own real estate directly and supports these costs can and should elect for ECI treatment. Not doing so would result in the property expenses not being offset against income, and the gross income being taxed at a high flat rates of 30%. A consequence of opting for ECI treatment which is the same advantageous treatment that US investors get, is that the NRA must file US income taxes with the IRS every year.

The election of ECI treatment is done by submitting an election with the tax return (US tax code 871(d)). To avoid withholding of 30%, the alien needs to submit a W8ECI form to his a property manager. He will require this before he distributes any of the rents to the owner, as he is registered as a withholding agent with the IRS. The NRA will need to fill a W8ECI form and send it to his property manager, whereas a US resident is required to file a W9 form.

Once the election is done, NRA should go through the initial setup and registration with IRS.

Initial Setup and Registration with the Tax Authorities

While all US residents are identified by their social security number (SSN), NRA need to obtain an Individual Tax Identification Number (ITIN) from the Inland Revenue Service (IRS). Obtaining an ITIN will allow to avoid susbtantial withholding tax on rental income and withholding on sales proceeds.

The ITIN can be obtained using a W7 form, which is filled using these instructions.

The IRS charges nothing to give an ITIN to a NRA. Some people will ask $75$ to $100 to fill it, You can print the form yourself, fill it with your personal details and send it so you know what you sent and when it was posted, and you'll receive the IRS answer.

- if you are in a country with tax treaty, you can file the W7 with case a

- if there is no tax treaty, you can file the W7 case b with his tax filing the year after he bought the house. So he got his ITIN later and could not get mortgage..

- as I wanted to get a mortgage in US, I could not wait for one year, I filed the W7 case h: mortgage for property investment, I enclosed a letter from a mortgage provider that said I need an ITIN to get a mortgage.

Advanced Tax Planning Resources

These link direct you to third party websites and documents:

- US Tax Guide for Aliens, document from the IRS, supposed ot be introductory, but reading does not flow.

- NRA Tax Guide similar information, with a conveniently formated list of tax treaties rates p25.

- Foreign person investing in US real estate a presentation for the American Bar Association, much deeper content.

- Portfolio Interest can be exempted from tax under certain conditions

- US Tax Code Section 871 rules on contingent interest

- AFR: Applicable Federal Rates

Legal Ownership Structure

Tax Implications of Legal Ownership Structure

The default mode of ownership is proprietorship by the individual. From an income tax point of view, the owner of the property is taxable on his net income, and there is no tax benefit in owning through a corporation.

Different entities other than individual can bet set up to own property:

- a partnership is a pass-through entity, and therefore, the tax treatment is the same as for sole proprietorship. A partnership allows several persons to share the benefits and responsibilities of ownership without changing their tax position.

- a corporation is viewed as separate taxable entities. Owning real estate through a corporation is inefficient from a tax standpoint because the corporation needs to pay the income tax. Then, the corporation owner will be taxable on any profits distribution distribution (dividends) from the company. This means that corporate activity is taxed twice.

- a trust is an entity whose objective is to hold and invest money or property held in the trust for the benefit of the beneficiaries. A trust is taxable. To avoid giving incentive for high income individuals to park their income producing assets into trusts, the income tax rate for trust quickly escalate to a level similar to the highest tax bracket for individuals.

Corporations shares can be sold and transferred easily, but distributed profits end up being taxed twice.

Limited Liability Companies (LLC) are viewed from a tax standpoint as partnerships unless they elect for corporate tax treatment.

For this reason, few corporations own income real estate in the US except in cases where tax on transmission matters more than taxation of profit (Estate). Most income properties are owned directly by individual or through a single member LLC or partnership LLC.

Legal Implications and Liability Protection

From a legal liability point of view:

- companies are independent judicial persons and its employees and shareholders have liability protection

- sole proprietorship and partnerships (not limited liability partnership, LLP) are liable for any tort arising in the course of the activity.

Companies, whether they be corporations, partnership or single member LLC are separate legal person and afford liability protection. If the proprietor or partners own the property through a LLC, they will benefit from liability protection.

The liability protection afforded by a LLC has several limitations:

- no protection for member criminal activity (The owners of a LLC are called members.)

- no protection for member from other liabilities arising outside the scope of the LLC

Even worse, the LLC liability protection may be disregarded by a court if they determine that it was a sham corporation. Factors leading to this are:

- LLC did not pay its fee to the state of incorporation every year,

- members commingled the LLC funds with his own, it should be clear what the LLC property and what member property is, this means that you either get a property manager

- members did not respect some forms, such as redacting an Operating Agreement, and signing contracts related to the property "for and on behalf of the LLC" with LLC Name, Person Name, member, rather than in their own names.

You can get further advise from a lawyer concerning liability protection.

About the author

I am a french mathematician and programmer living in Hong Kong. I started to invest in real estate in the late 90's. As I work in Asia since 2006, I started to compare my european investments with Japan, Hong Kong, and invested there. As I saw the recovery after 2009 financial crisis, I came to the conclusion that the US real estate was one of the best investment given the high rental yields and affordability of housing in the US.

My tax status is Non Resident Aliens (NRA). In 2013, I started to gather information on taxation for US real estate investors as a NRA. Taxation of rental property income is a very significant determinant of net yield, and ultimately key to comparisons with other investments. Yet, I found it difficult to obtain relevant advise for an investor whose sole US income is the $1000 per unit per month he gets from his property.

In such a case, paying susbtantial fees to a tax preparation specialist undermines the profitability of the investment. Moreover, I found that the knowledge of such specialist on matters of international taxation was limited, and that they could hardly comment on the comparative profitability of the many possible setup that are available to foreign investors.

I decided that understanding how taxes are filed would enable me to make for informed decision concerning real estate comparative profitability compared to other investments such as bonds and equities.

I obtained an Individual Tax Identification Number (ITIN) in late 2013, and filed my first tax return in 2015 for the 2014 tax year as a NRA. This is what I found to work adequately for an NRA investor based whose sole US income source is rent.