2020 Rentals Performance Review

Overall performance

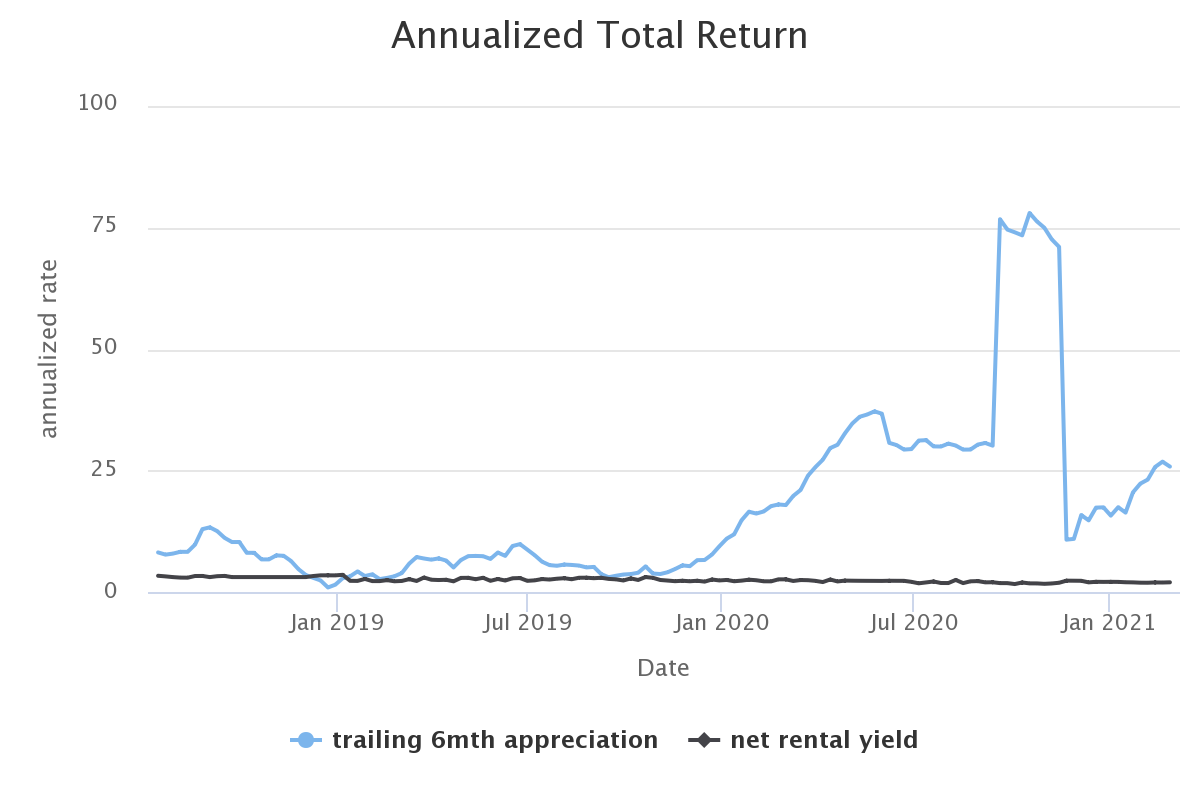

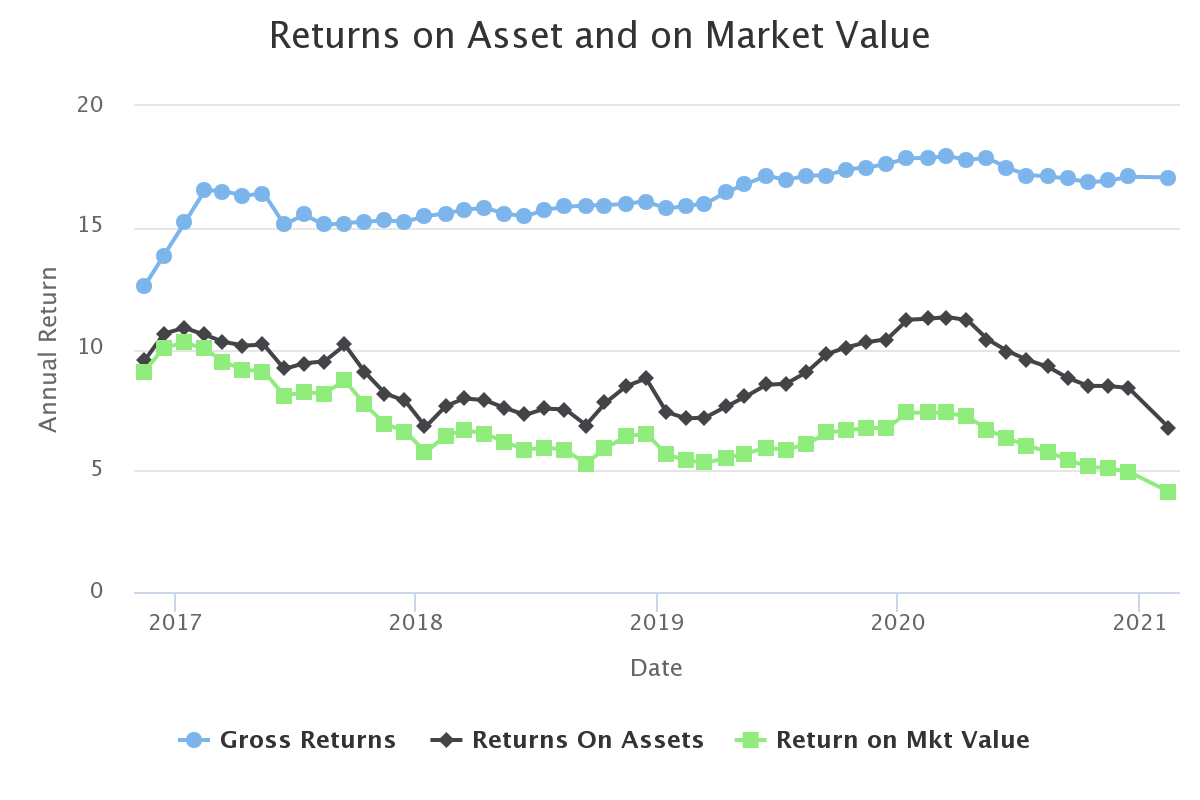

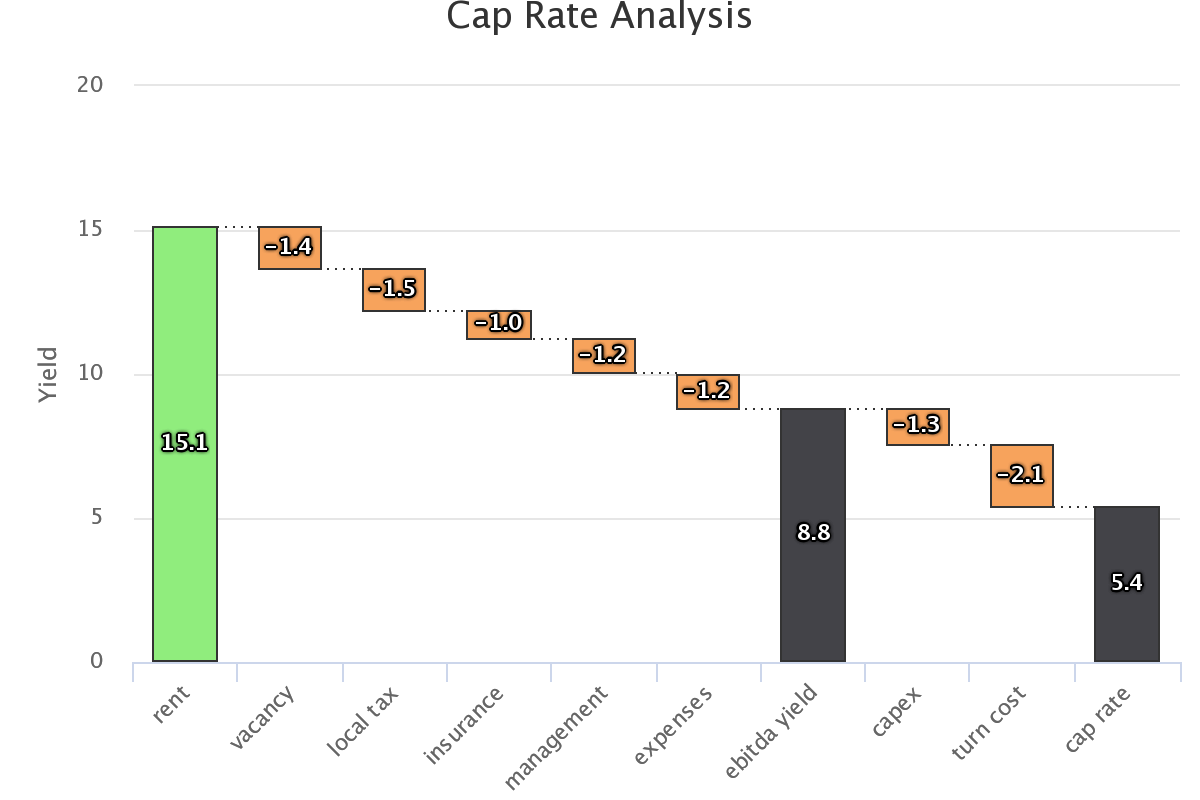

Here are the highlights at the national level:

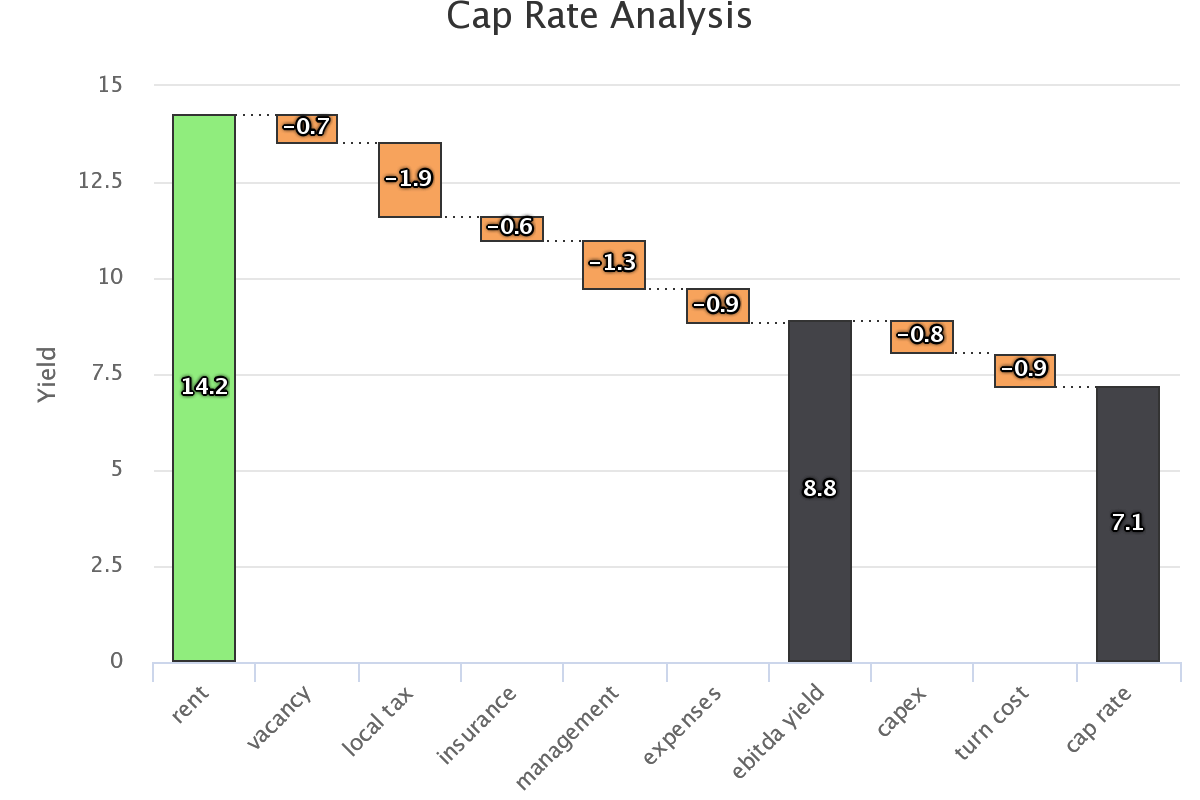

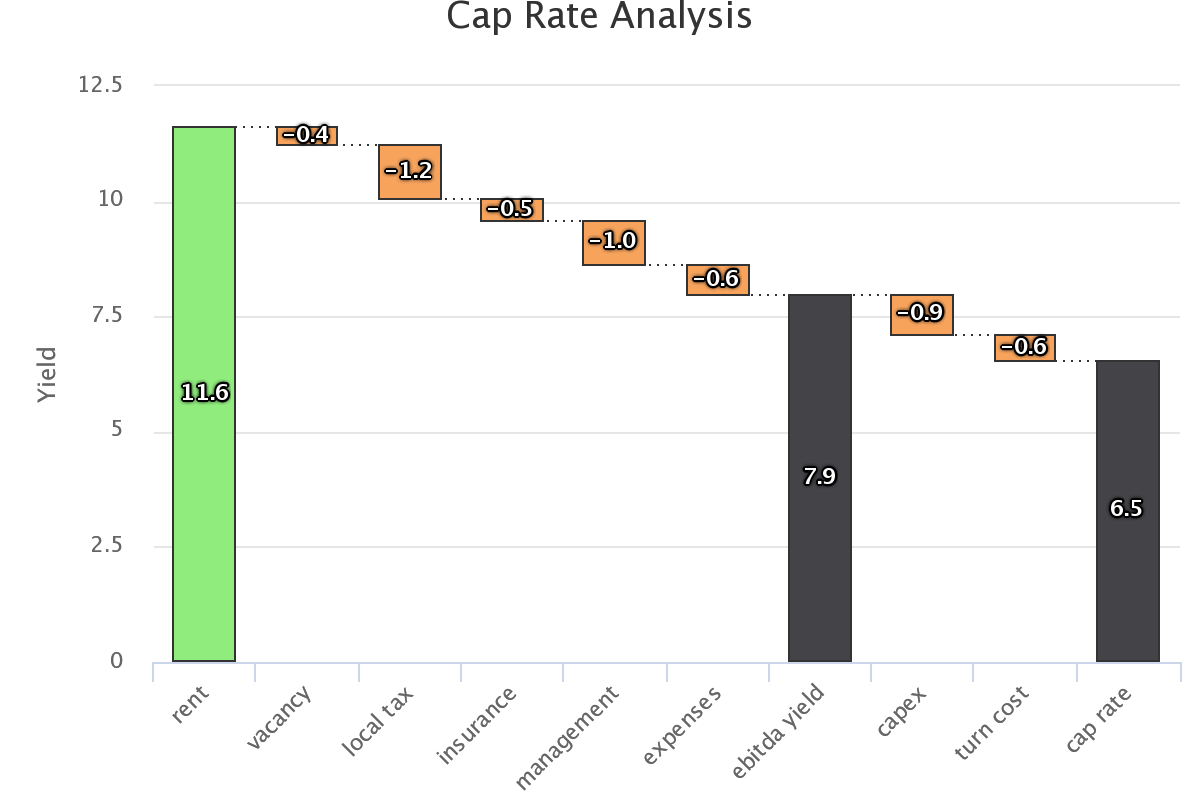

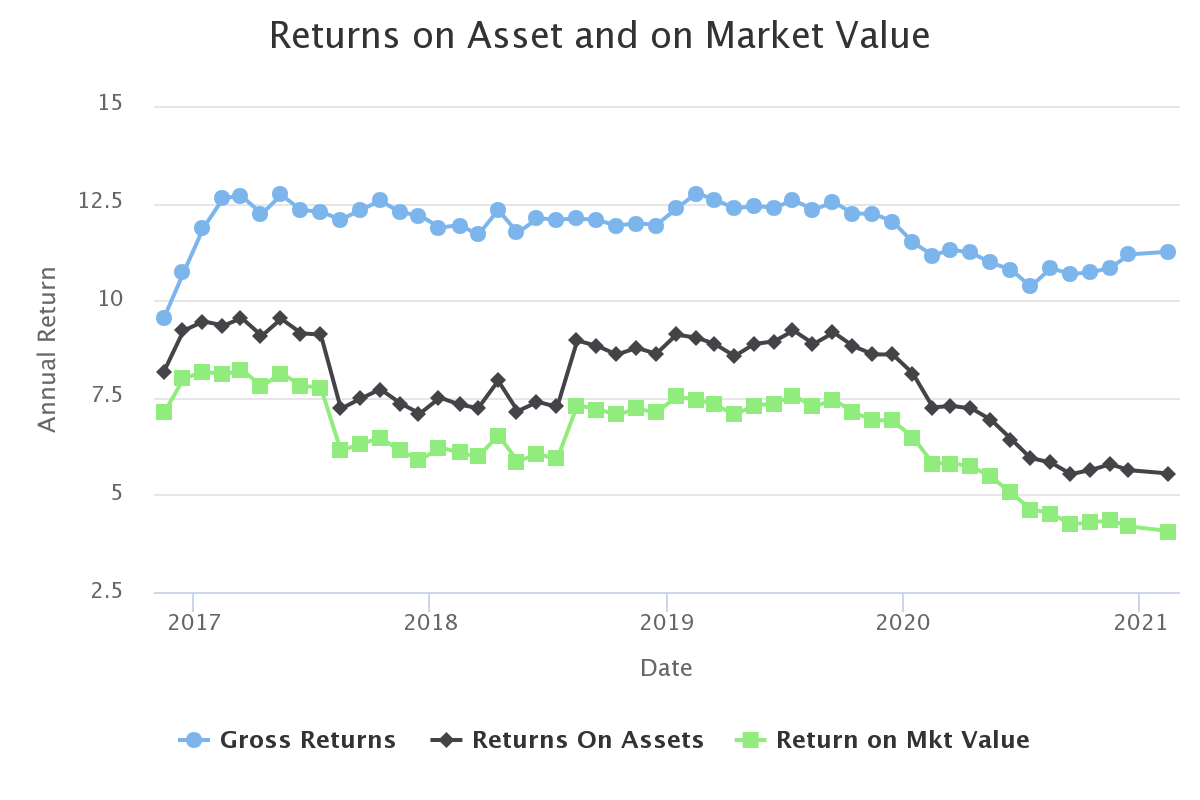

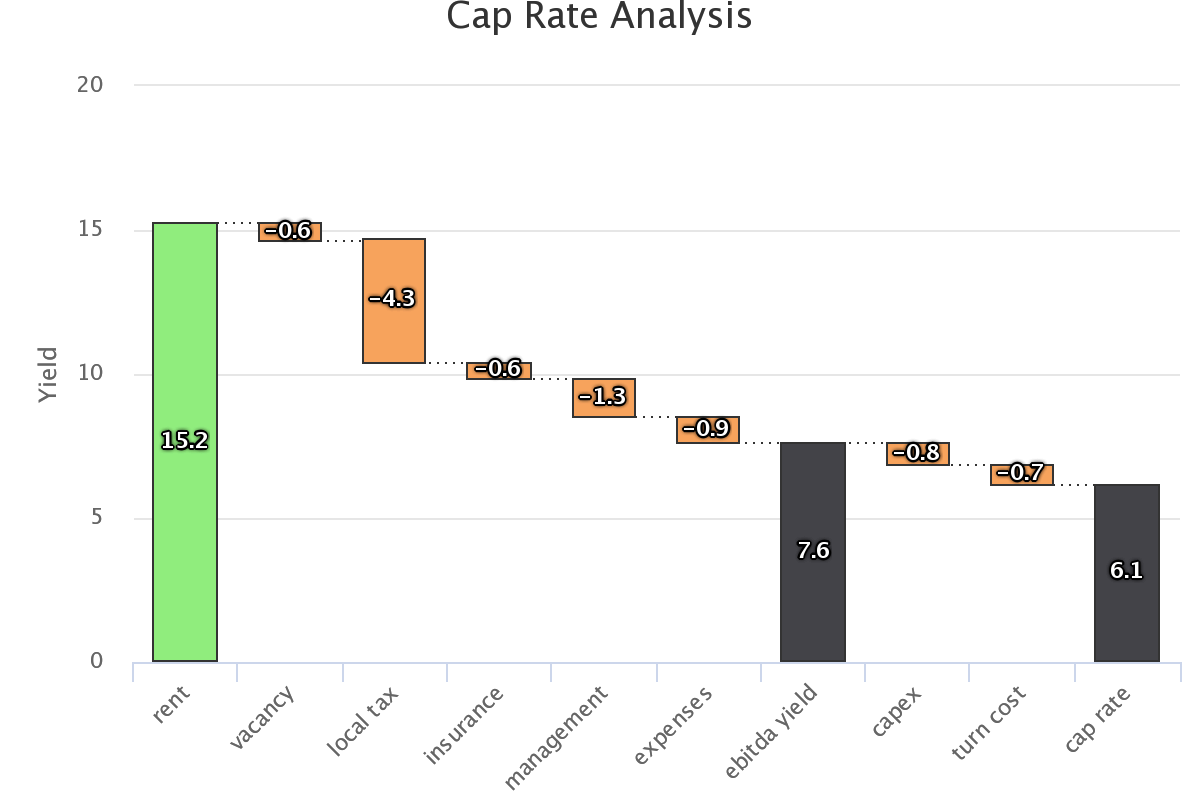

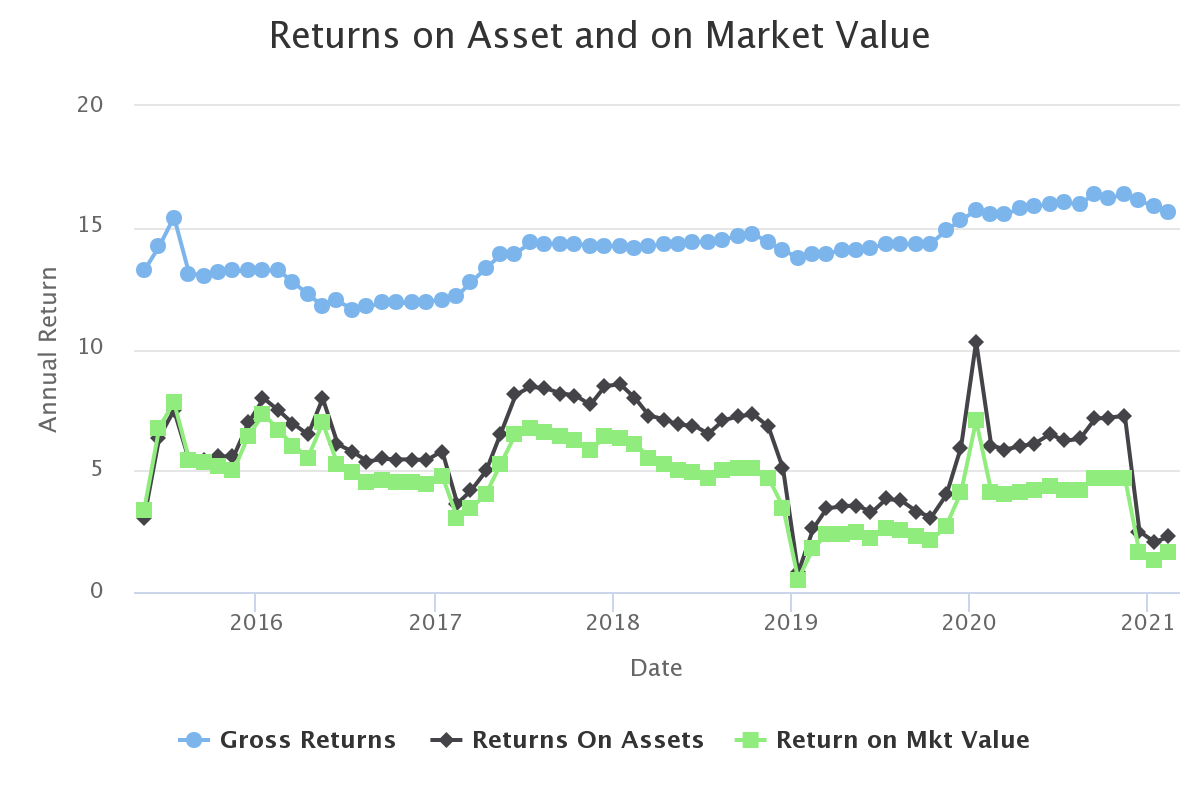

- rental yield target proforma numbers are above 14% gross yield, 7.1% net yield

- actual vacancy was low and most tenants paid, which means that actual gross yield was nearly 12%

- expense grew much faster than rent, with property tax and repair cost raising quickly.

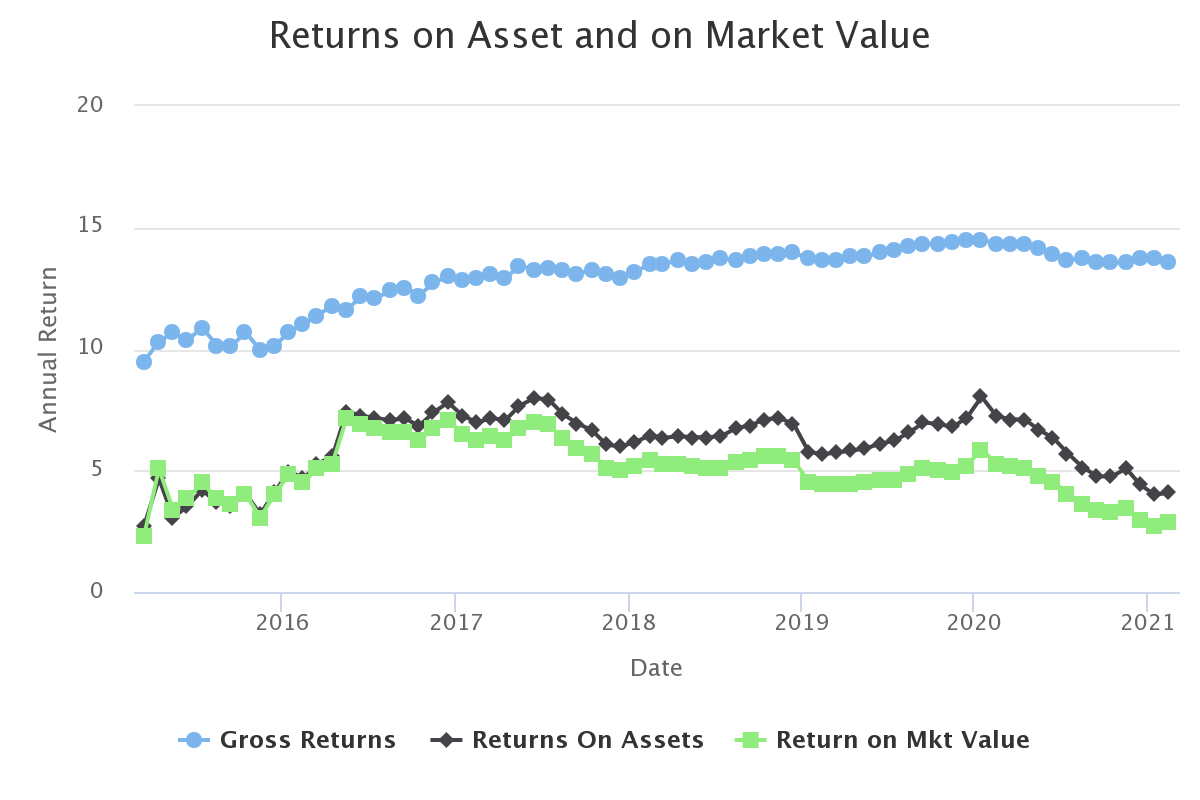

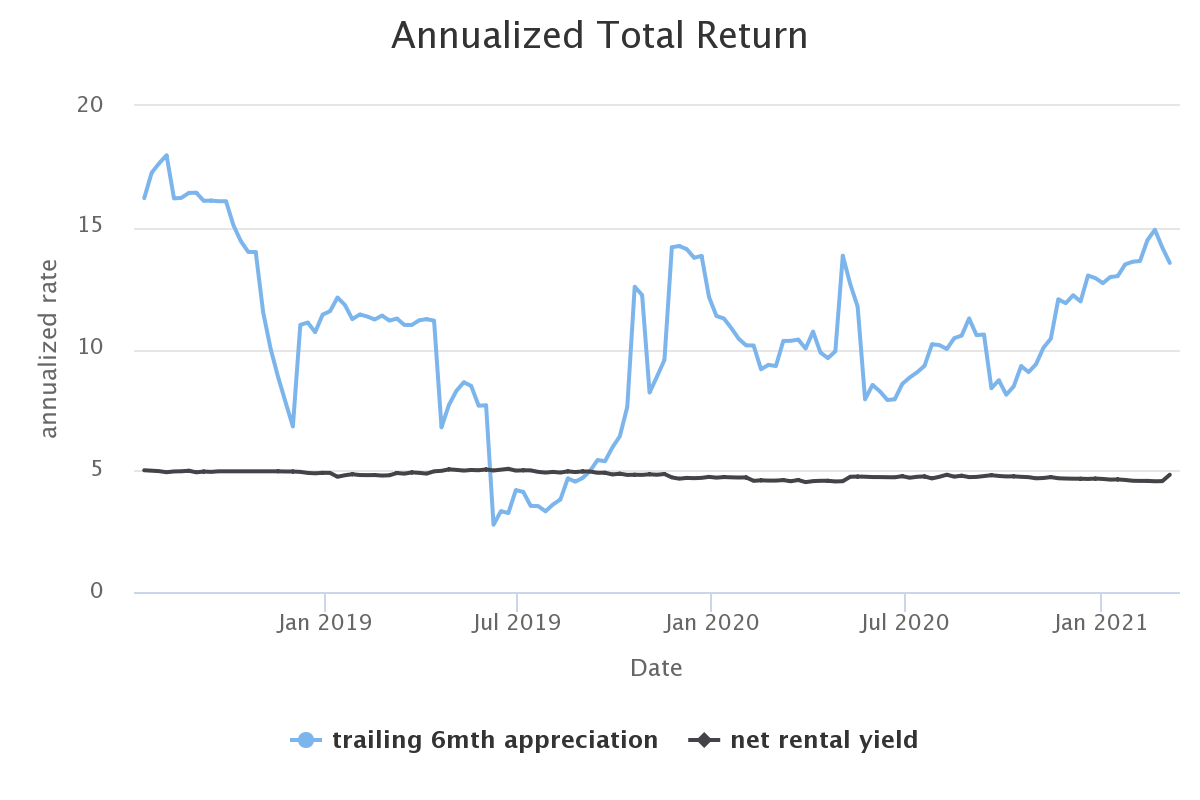

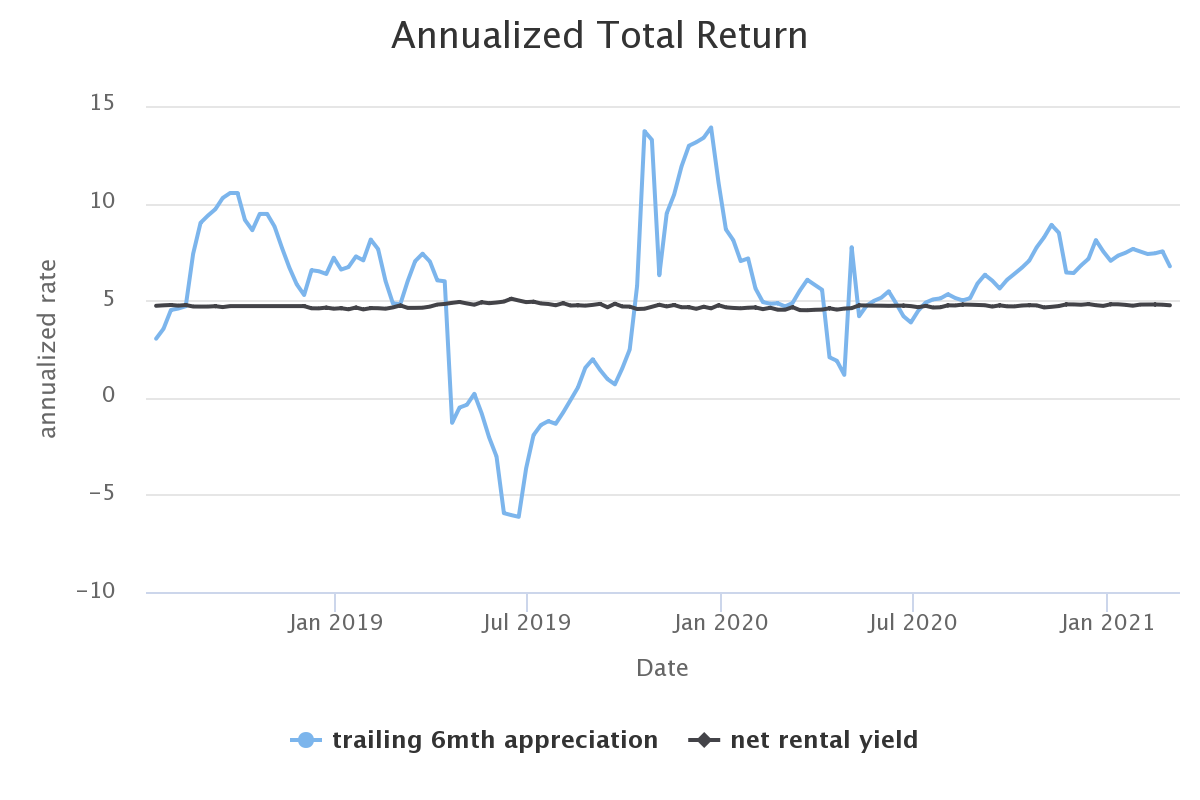

- While actual net yield was near 7% in 2019 as per proforma, it went down to 3% in 2020.

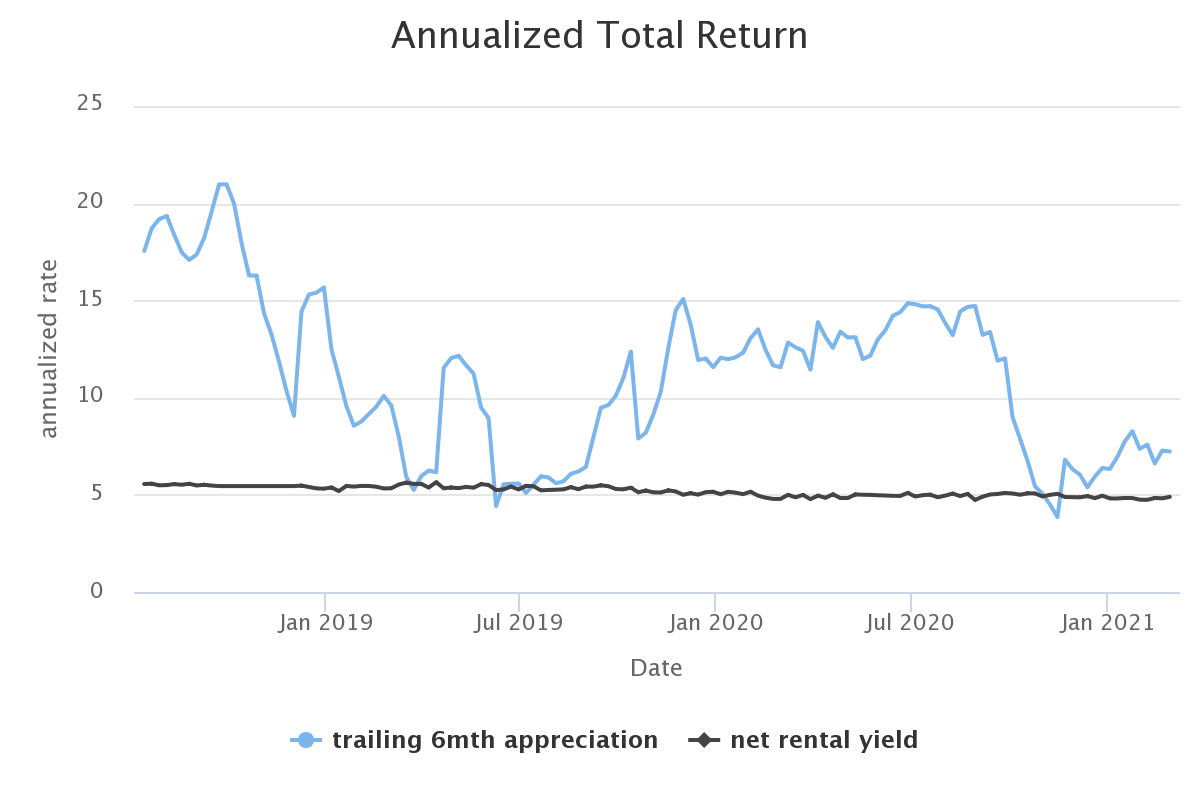

- price appreciation in the low teens is now a major contributor to total return.

Arizona

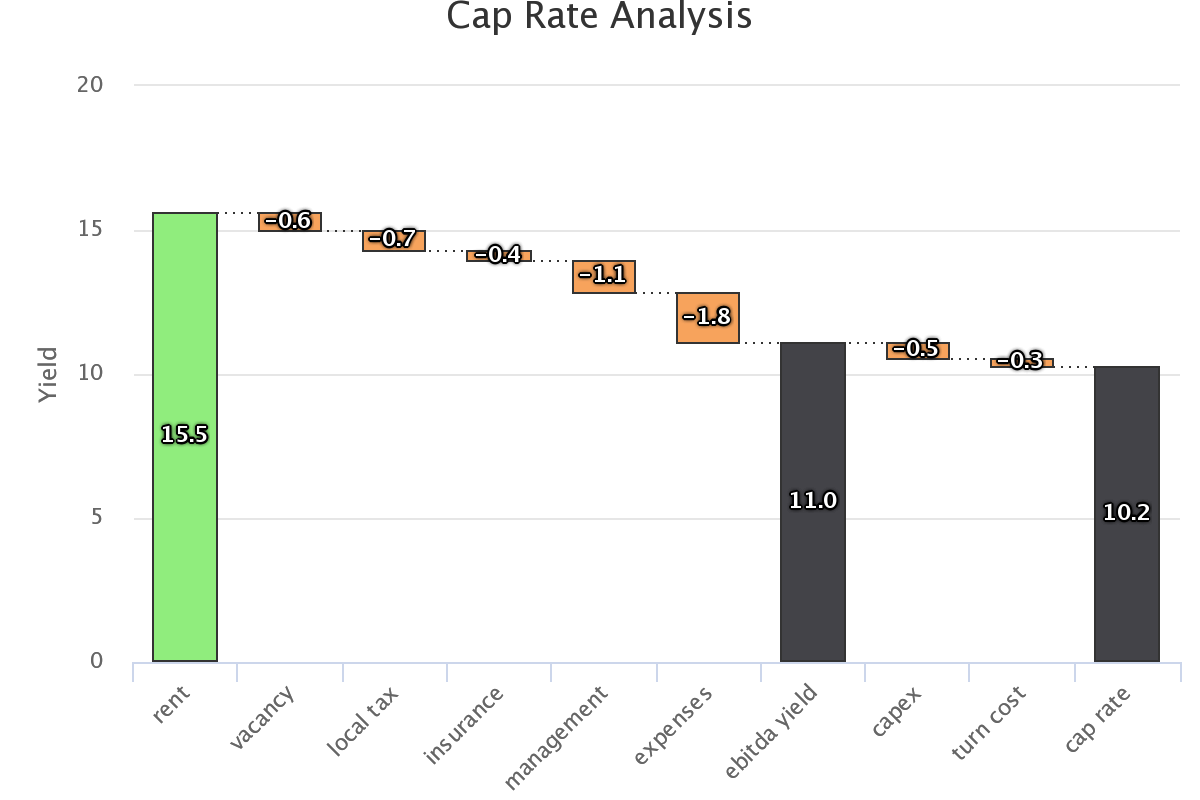

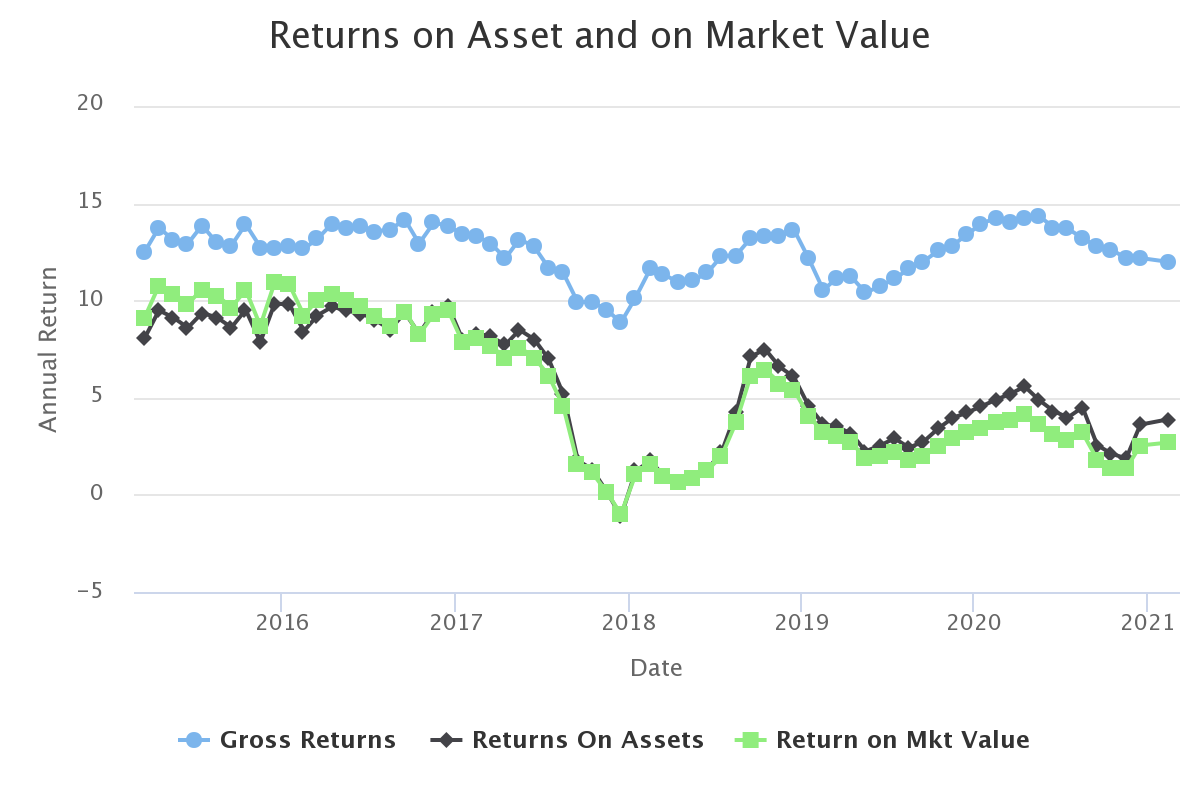

Here are the results for Arizona:

- vacancy staid low at around 5% on the

- proforma is a high 10% net for a 15% gross yield

- actual performance in 2020 was good and near 10%

- property is restricted to above 50y old by covenant, which makes comparison sales and appreciation harder to evaluate. Zillow is having a hard time catching up to the property being a triplex.

Steady performance by the property manager, good appreciation and low cost inflation. That's a keeper.

Florida

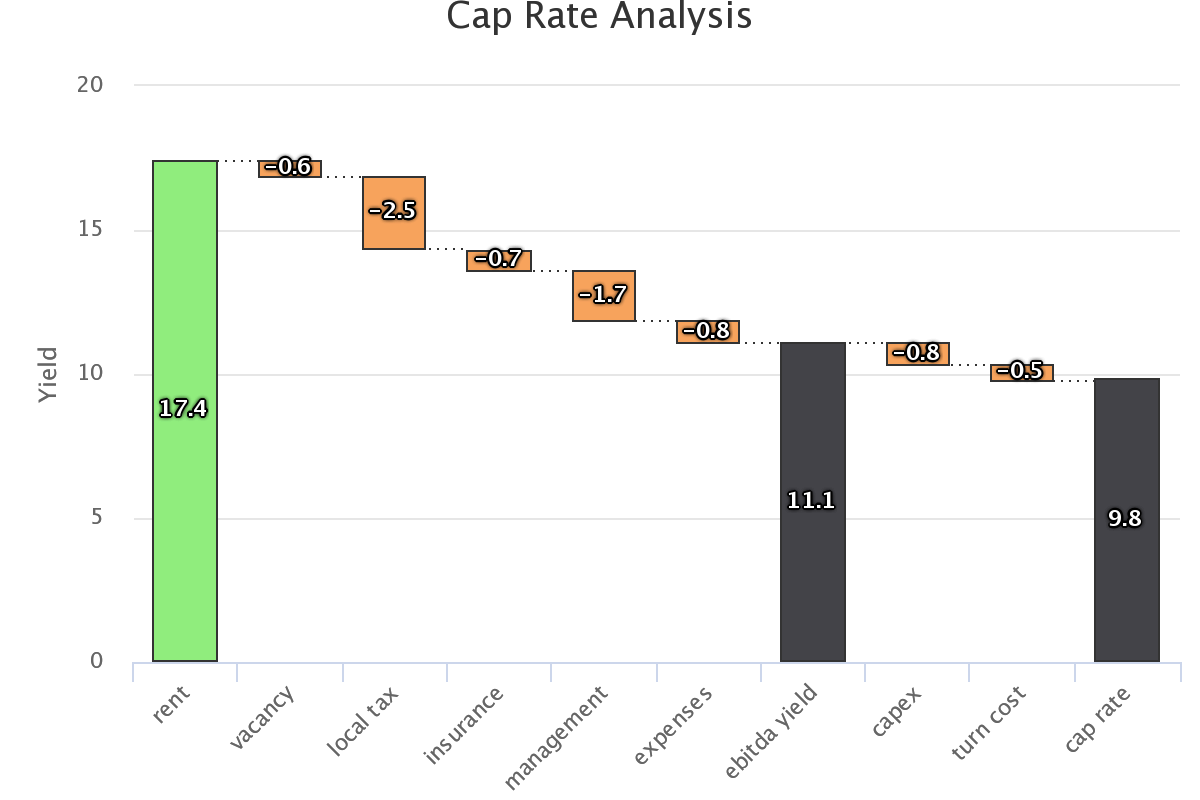

Here are the results for Fort Lauderdal, West Palm Beach and Tallahassee:

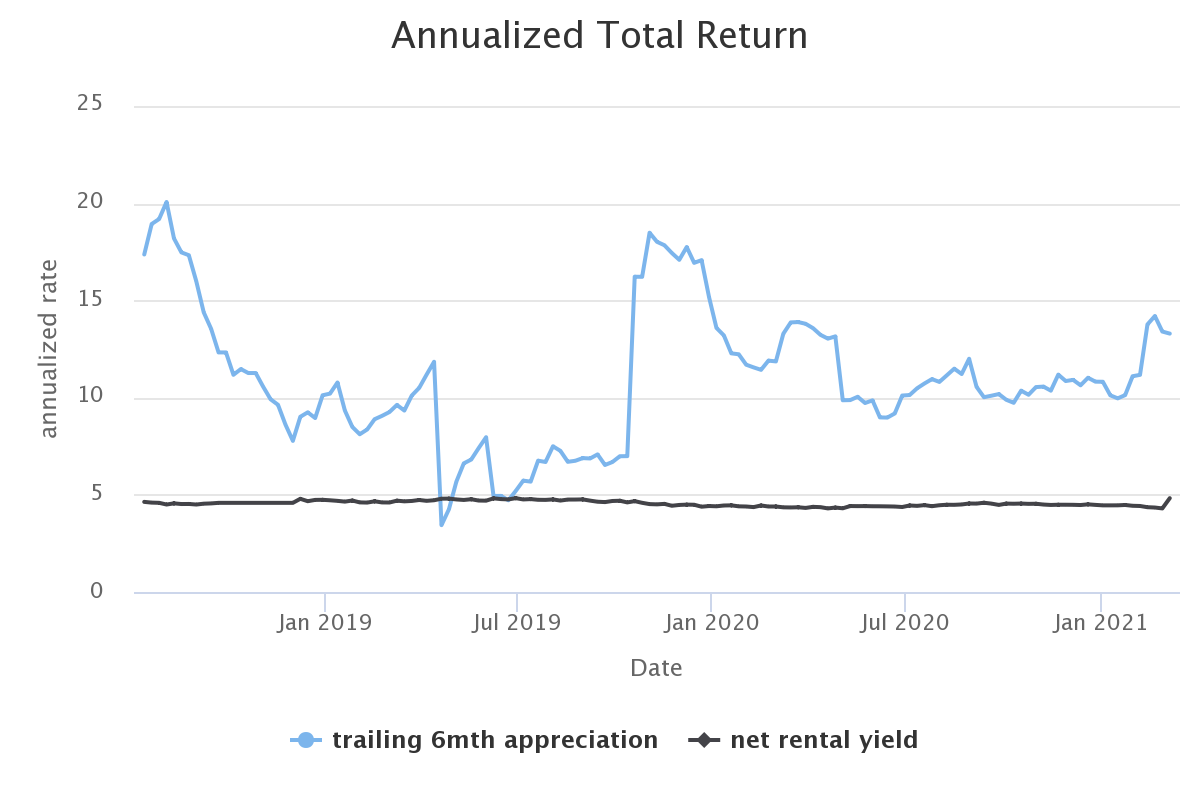

- vacancy exceptionally low below 5%. The market is good and the PM do a good job

- proforma is a high 10% net for a 17% gross yield

- actual performance in 2020 was lower 8% because taxes are increasing

- appreciation is below 10% recently

Very good work by the property managers this year who had to work with difficult tenants. Appreciation should continue with NY exodus.

Georgia

Here are the results for Atlanta:

- vacancy is too high, indicative of property hard to rent or PM problem, I decide to sell Wexford

- proforma is a high 5% net for a 12% gross yield

- actual performance in 2020 was lower 4% because I was busy selling Wexford

- Wexford sold quickly and appreciation is as fast as 20% recently

This is a market for flips, not rentals. I will need to sell these houses to homeowner, but appreciation is too good for now. As cheaper hoods are catching up.

Misssouri

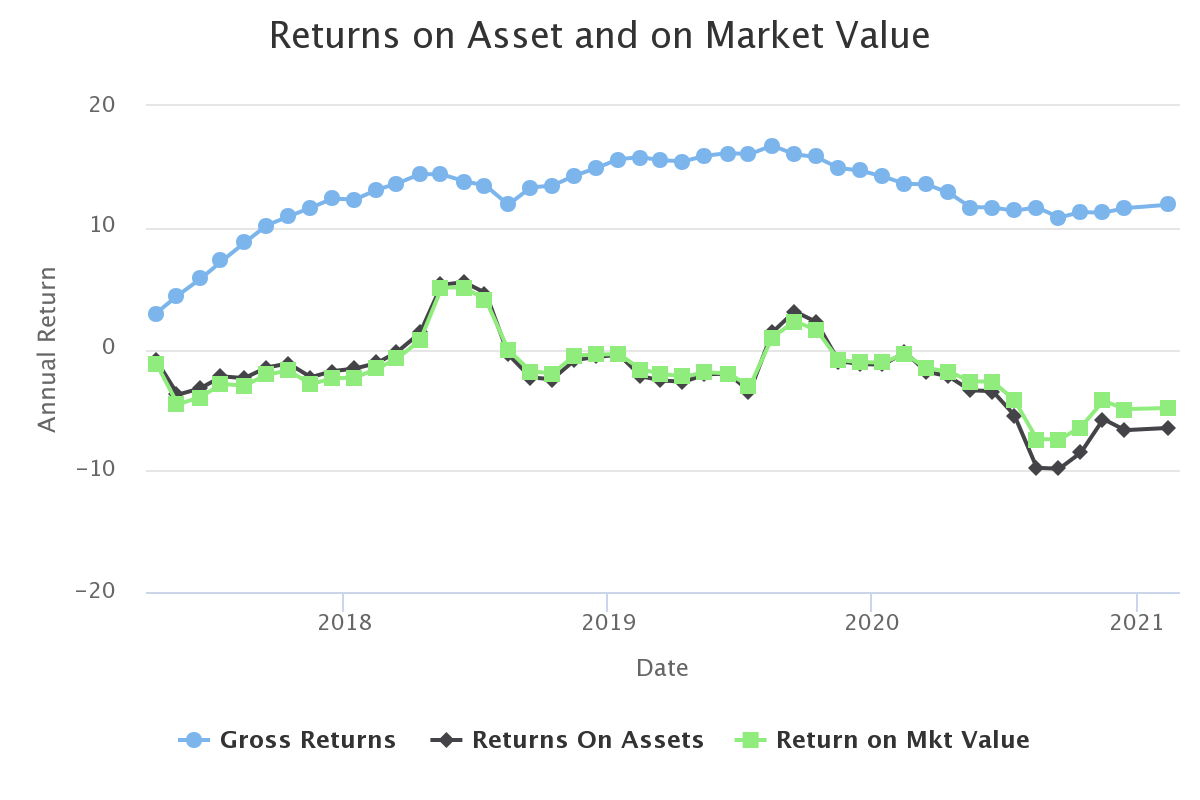

Here are the results for Kansas City:

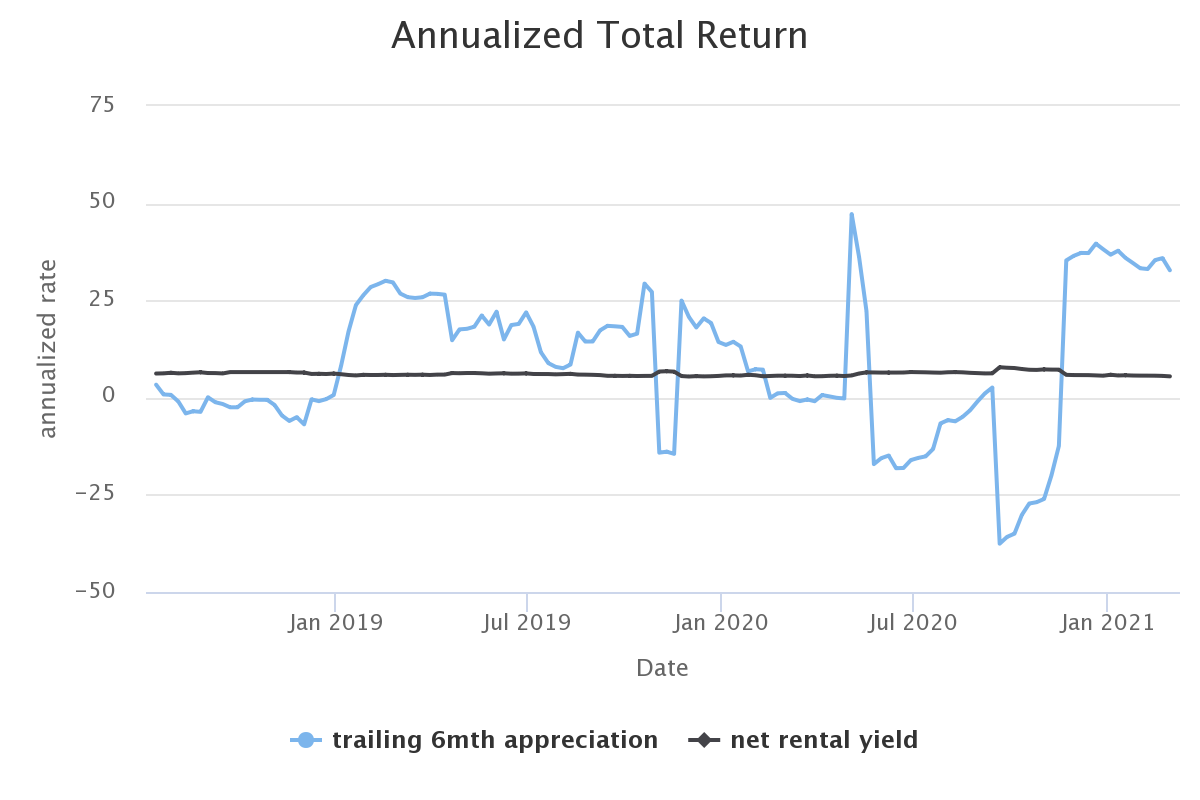

- vacancy is too high, indicative of property hard to rent or PM problem, I decide to sell e gregory

- proforma is a high 5% net for a 15% gross yield, this

- actual performance in 2020 was negative, I never made money on operating these.

- appreciation is running at 25% on these according to Zillow

Kansas City is a special situation. I continue to work closely with PM to go back to positive. Appreciation is good. New Mayor Lucas is hostile to private landlords.

North Carolina

Here are the results for Charlotte:

- vacancy is too high, indicative of property hard to rent (smaller than rest of tract)

- proforma is a high 6% net for a 11% gross yield, this

- actual performance in 2020 was 6%, there was many repairs needed this year

- appreciation is running at 10-15% on these

A great market, low expense and good appreciation. We need to be careful with cost control.

Texas

Here are the results for Dallas Fort Worth:

- vacancy is too high, indicative of PM taking too much time for rehab, I decided to sell Baretta

- proforma is a high 6% net for a 15% gross yield, due to high tax

- actual performance in 2020 was 2.5%, there was many repairs and vacancy in Baretta

- appreciation is running at 5% on these

Appreciation is slow currently. I described my Baretta sale in a previous article.

| Tweet |

| |

| Click here to share this on BiggerPockets.com! | ||