Seville: safe, clean, low cost of living city

Seville (Spain) appears as one of the 3 most affordable, safe, unpolluted cities in the world along with Porto (Portugal) and Split (Croatia).

image credit: wikicommons

Prices and Gross Yield in Seville

Prices for a 2br range from 200k to 600k euros, for an apartment 2500/sqm to 5900/sqm. Rents range from 600 to 1200 for an apparent yield around 4%.

Short Term Stay Regulations

According to property guides, Andalusia changed its short term rental rules in 2016, and now requires registration with a VFT to accept tenants below 60 days. There are regulations concerning the provision of air conditioning in May to September and of linen and housekeeping service to the tenant.

Wider Spanish Market

Global property guide explain that Barcelona and Madrid see prices in the 4300 to 6000 euro/sqm range with gross yield from 4% to 5%.

- rent control with increase limited to CPI

- tenants are guaranteed tenure for 5y with painfully slow resolution if rent is not paid

Income Taxes

- 24% flat tax on rental income

- CGT of 19%

- 3% tax on cadastral value levied on non-resident, cadastral (or rateable) value can vary compared to market value but is expected to be around 50% of market value according to idealista.

Fiscal Sustainability

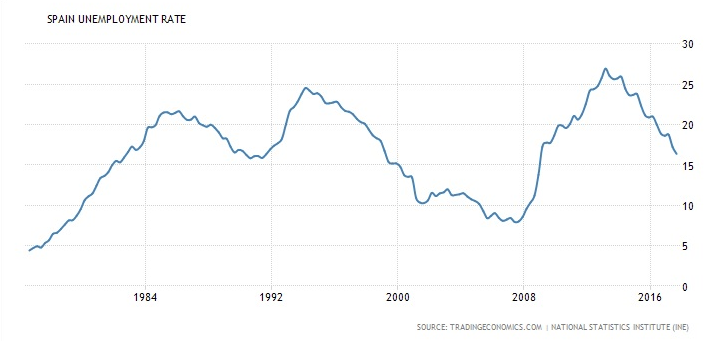

One reason for concern with this country is unemployment.

Spain has unemployment statistics that regularly exceeds the 25% of the US great depression. I asked a Spanish colleague how Spain survives a 25% unemployment. He told me that people claim the benefit and work in the informal sector. The good news is that 25% of Spaniards were not dying of hunger in the streets in 86, 95 and 2010.

What transpires here is that the administration has ramped up incentives for the population to register for unemployment. High fiscal load is unlikely to abate as this incentive problem has been created by politicians in the 70s and that they have been actively maintaining this state of affair for the last 50 years as long as Spain existed as a constitutional monarchy.

Conclusion

We are talking of a 4% to 5% gross yield, with a 24% income tax and a 1.5% non-resident wealth tax. The rental yield opportunity appears limited based on these numbers. The opportunity for capital gains was in 1998-2006 when the Spanish mortgage rates went from 10% to 2% following Euro convergence and further rates lowering until the GFC.

| Tweet |

| |

| Click here to share this on BiggerPockets.com! | ||