Dubai: Affordable Market Increasing in 2022

Dubai: booming since 2021

I looked into this market in May 2020, it was in free fall. Dubai now seems to be booming since 2021. The increase starts with luxury (villas above AED 10m) and flats (Dubai Marina flats above AED 2m) and is followed by an increase downmarket.

image credit: wikicommons

Important for buyer: tenanted flats and rent control

Rent control was introduced in 2007 in Dubai, and then revised 2008 and then again in 2013 to allow some rent increase. The long term impact of rent control is viewed by most economist as comparable to bombing a city in terms of impact on housing availability and quality. This information is discussed by agents involved in selling property to investors, but Dubai newspaper write about it in articles intended for expat tenants and lawyers catering to tenants are more willing to discuss the modalities of rent control..

A 90 days notice is required before raising rents, before the end of annual lease. The rent amount is limited as follow. If the existing rent is:

- Less than 10% below the average market rental rate – no rent increase is permitted.

- Between 11% and 20% below the average market rental rate – maximum 5% rent increase is permitted.

- Between 21% and 30% below the average market rental rate – maximum 10% rent increase is permitted.

- Between 31% and 40% below the average market rental rate – maximum 15% rent increase is permitted.

- More than 40% below the average market rental rate – maximum 20% rent increase is permitted.

Note that the market rate is what RERA decides the market rate to be. Average rent is by area and which favours landlords of lower quality buildings but RERA is gathering more data as every tenancy contract needs be registered with RERA, so it may change the way it decides what market rental rate is.

- according to this article, eviction notice by previous landlord is not valid, the flat must be vacant before prospective owner buys it.

- according to this article notice must be sent 12 month in advance, notice for personal use requires no other property in Dubai, notice for sale requires the tenant to leave before sale occurs otherwise, new landlord needs to send a notice again and needs to sell or live there personally.

There was a draft law in Jun 2021 to "freeze rent" for 3 years, but in this case, tenant is committed to pay rent and cannot walk away. One would imagine the landlord could require a cheque for 3 years.

The current 2013 law an improvement for the landlord compared to 2011 rent caps, which were as follow:

- 5% where the existing rent is 26 per cent to 35 % below the average rents for property in that area,

- 10% where the property is 36 to 45 % below market rent

- 15% where it is 46 to 55 % below the market rate

- Maximum of 20 % where it is more than 55 % below.

However, rents that are less than 25 per cent of the index rates could not be raised.

Landlords are playing a game of catch up with market rent. In a high inflation situation, this would mean that rents real value vanish. This, however, would require 40% inflation on USD since the AED is pegged. With lower inflation, rents should keep catching up to 10% below whatever RERA decides is the market level. So far RERA uses the average rent for the a large area, so that older developments rent weigh down on the rent of more expensive ones.

The long term tenancy investor needs to buy a goldilocks flat:

- if the tower is too high quality, the rent will converge to a much lower value

- the the quality is too low, the flat will have long vacancy

Renovations are highly controlled, usually only allowed for 3h per day, from 11am to 14:00, with contractors often struggling to renovate to a low standard (e.g., bathroom tiles not set straight...).

Golden and Investor Visas:

- 2y visa for investment of AED750k (200k), cost: AED 10k. see here, need to stay more than 6m per year to keep visa valid.

- 5Y golden visa for retired for AED1m (270k) must be 55 or older or have worked 15 years. see here and here

- 10y golden visa for investment of AED2m (540k) in one or more properties, see here, there is no need to stay to maintain residence

Dubai sales acceleration

Dubai government provides sales data. We see an acceleration in the number of transactions, and the total amount transacted.

This is a rather new trend since 2021, prices in Dubai are recovering from a long downtrend from 2014 to 2020 that I wrote about in 2020. That downtrend was made more painful as all developed countries' real estate markets were going up.

Finding Properties

The most popular websites are propertyfinder.ae and bayut.

Beware that many adverts are "unverified" and agents will tell you that the property is already under contract and try to sell you a property in a development where they get the best commission (typically, new build sold on plan leads to better commissions for the agent). This technique is usually known as "bait and switch".

Another pitfall is that Dubai growth is planned, not organic, and that it takes many years to understand how new builds fit in the city. For instance, much of the south of Dubai Marina has trafic jams at commute times, so that the north part of the marina turns out to be more convenient. Buying a building with a direct marina view is guaranteed not to change, whereas a seaview at a high floor, may become obstructed if the land in-between is still up for development.

Developers other than state-owned Damac and Emaar are known to skimp on maintenance or jack up the price of maintenance on the residents. For this reason, these two developpers are to be preferred. Special mention should go to a building called "The Torch" near the Marina, which had a major fire in 2015, affecting floors from the 50th to the top of the building on the 86th floor and resulting in 101 flats becoming uninhabitable, after the extensive renovation work, the Torch had 2 more fires. The flats sell at a significant discount.

The torch second fire in 2014: image credit: Dalia Kaki and BBC

Dubai Real Estate and Oil Price

An interesting point discussed with another expat investment specialist is the importance of buying seasoned projects and the apparent correlation of Dubai real estate with oil price levels. Below is the brent levels evolution:

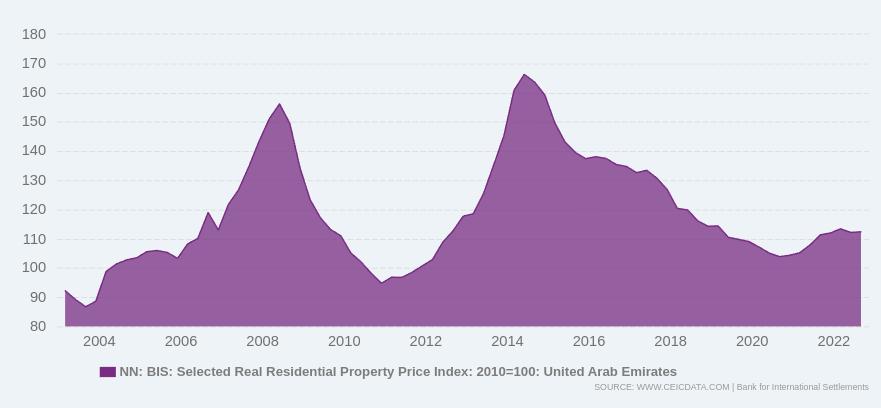

Here is the Dubai price index from 2003 to 2023:

source: ceicdata

The theory is that Dubai gets bankrolled by Abu Dhabi, so high oil price helps.

The relationship seems less strong now based on the graph above, but the price index shown by CEIC from 2021 to 2023 appears to increase by only 10% in 2 years. whereas prime buildings in the Marina saw their price/sqft increase from AED1500 to 2500, a 66% increase in 2 years.

Dubai Marina Price by sqft Trend

We show below all available data points as well as rolling transaction quantiles for 1,2 and 3 bedrooms:

Dubai Marina Best Projects

In Dubai Marina, we setup observation for the following, note that projects completed less than 5 years ago have all the trappings of high fashion and may not hold value as a 15 year old development.

- Damac Heights, 640 units on 86 floors built in 2018, 2br 2.1 to 3.5,1600/sqft search

- Marina Gates, 508 units on 57 floors built in 2020, 2br 2.5 to 5.5, 1752/sqft search

- Vida Residence, sold on plan, 2.5 to 5, 1952/sqft search

- Marina Promenade, with up to 39 floors built in 2008, 2.35 to 3.2 , 1720/sqft search

- Marina Quays with up to 40 floors built in 2010, 2.2 to 2.8, 1750/sqft search

- Silverene with up to 37 floors built in 2011, 1.9 to 3.6, 1718/sqft search

- Marina Terrace with 200 units on 38 floors built in 2002, nothing for sale, search

- Dubai Marina Towers aka EMAAR 6, 1121 units on 40 floors built in 2003, 2.7 to 4.1, 1744/sqft search

- Cayan Tower 70 floors built in 2013, 1.9 to 2.7, 1519/sqft search

- Bay Central 44 floors built in 2012. 1.6 to 1.9, 1433/sqft search

AED is closely pegged to USD, so mortgage rates recently increased, which may dampen the market.

Deep Dive by Project

Median data are harder to get from the data due to the disparity amongst developments, some transactions show the development name, which enable our charting the evolution of prices amongst comparable properties:

Real Estate in a few World Cities

- Paris: real estate has been made unaffordable for its local population by a protracted period of low rates. The market is at risk if the Eurozone has higher rates.

- London: the market is also unaffordable but more landlord friendly. Floating-rate mortgages may cause some distressed sales.

- Istanbul: I am in contact with agents who actively look for properties in Istanbul. The inflation and Turkish lira depreciation makes holding real assets attractive, and causes local sellers to be finicky. The situation is very difficult for buyers and even more for landlords. Landlords have problems with long-term Lira-based tenants as the government instituted a 25% cap on rent increases while many tenants saw their salary double.

- Singapore: lost many expats to the lockdown, however, rents are now surging due to expats moving in probably from Hong Kong.

- Hong Kong: Asia world city is losing many expats, leading to higher vacancy which put downward pressure on rents. r, 772sqft 7th floor, large living, bad deco bathrooms, 1.25m, 68k tenant 5apr, 13k service fee, 75k-85k mkt rent, 4.4% net, 5.76% potential

Update 20230201

We can still see the difference between Damac Height with rational floorplan and good kitchen/bath vs Elite Residence which has terrible floorplan and kitchen. Now Elite Residence has the ultimate gym.

- damac height 1398sqft @ AED2.5m = USD680k, AED1788/sqft, USD 5238/sqm

- Elite Residence 1329sqft @ AED1.6m = USD435k, AED1200/sqft, USD 3500/sqm

Companies to help with Deco and Mgt of Short Stay Flats

- BlueGround

- GuestReady

- Dubai only: StoneTree

- Dubai only Deluxe Homes

- Istanbul/Bodrum only VNG property

Product examples:

- Marina Quays 1br, 772sqft 7th floor, large living, bad deco bathrooms, 1.25m, 68k tenant 5apr, 13k service fee, 75k-85k mkt rent, 4.4% net, 5.76% potential, tenant left 20240405, asking 1.5m

- Damac Res 1br, 952sqft, large living, low floor, ok deco, 1.7mln, 85k mar24, 14k service fee, 120k mkt rent, 4.18% net, 6.24% potential

- Damac Res 1br 950sqft, fendi, high floor, 1.95m, 105k, 14k service fee, 130k mkt rent, 4.67% net, 5.95% potential

see dubai trustee offices info for second hand sale transaction.

| Tweet |

| |

| Click here to share this on BiggerPockets.com! | ||