Large portfolio of houses: an asset class since 2012

In 2012, investor Warren Buffet suggested that buying distressed houses and renting them was probably the best investment opportunity at that time provided you could execute correctly on the maintenance and management.

Later in 2013, an investment advisor in Hong Kong told me that he had bought a Single Family House (SFH) in Texas and that it was yielding 25% gross and 15% net, but that such opportunities were gone because of Hedge Funds buying everything since then.

Foreclosed homes glutted the market. Local small landlords could not finance so many houses and the other real estate professionals needed a rising market to operate. As prices cratered, Investors stepped in to buy to rent these houses.

As I explained in 2016 in the case for US Real Estate investment, with a) financially repressed bond yields and b) REIT performance strongly correlated to the stock market, the case for direct holding of real estate to achieve inflation protected returns uncorrelated to equities was compelling then as it is now, albeit with much lower yield and capital gains prospects now for SFH and equity holdings now.

From 2017 to 2018, Freddie Mac (a state sponsored agency involved in refinancing mortgages, lowering their cost to homeowners) started a pilot loan program to lower the cost of financing large scale residential real estate purchase by investors. You can read Freddie Mac white paper about this nascent market. Some of its analysis is based on deeper original research pre-published in 2015 at the Federal Reserve Board.

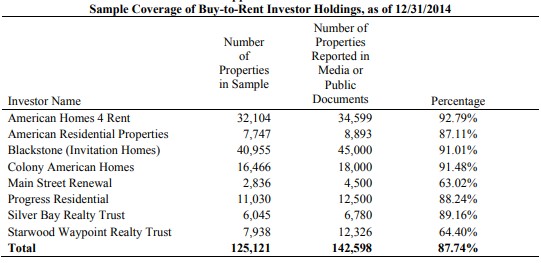

The new large institutional investors are named in the FRB paper:

Before 2012: the case for Smaller Local Landlords

For a very long time until 2012, single family houses were not a good investment vehicle for institutional investors because

- small private buyers can get preferential financing for their first 10 properties

- local knowledge and supervision helps avoid mistakes at purchase time

- hands-on landlords can considerably reduce cost by preventative maintenance,

- small landlords can self manage properties

A local investor can probably save 1% of gross yield from financing, 1% from management and 1% on maintenance, which helps to a total of 3% additional net rental revenue. This is a substantial advantage.

In a normal market, the most efficient local landlords could buy up to 10 houses at rates cheaper than bigger investors and manage them efficiently. This would push up prices to an elevated level that made the purchase unprofitable for larger, less nimble investors.

Catching the turn of the 2011 Foreclosure Wave

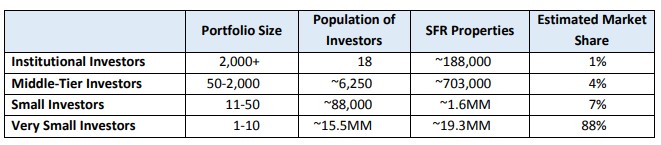

The investors can now be categorized by size, with the impact that follows:

This graph illustrates the birth of this asset class:

The main circumstance attendant to this was a) the arrival on the market of many foreclosures and b) the reluctance of lenders for small landlords in a falling market:

- a national foreclosure wave had negatively affected the market from 2011 to 2013

- banks were unwilling to extend credit in a situation of falling house prices

- investors who were able to pay cash could buy houses at steep discount and below replacement value

- new trends such as the sharing economy put more emphasis on renting than buying for millennials

In this context, constructions starts for multiunit housing recovered faster than single family housing.

Criteria Driving Buy 2 Rent Investment

The criteria driving sound rental housing investment are outlined in this April 2017 review of the rentfaxpro service. The table below shows that the most popular houses are 3 bedrooms, and that the buy 2 rent actors are generally buying far more affordable houses (much lower price per sqf and lower area):

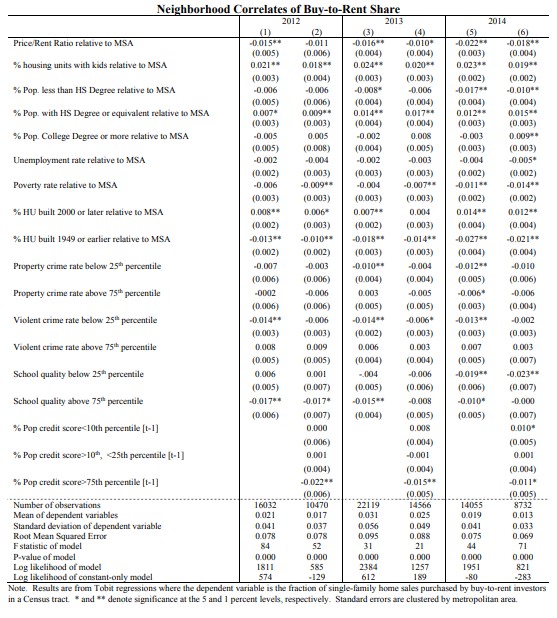

The FRB article give insightful statistics on the choice of hood. Criteria are:

- avoid high price to rent ratio

- avoid well educated tenant

- avoid high unemployment area

- avoid poverty

- buy more housing built since 2000 avoid housing built earlier than 1949

- avoid high and low property crime area

- avoid low violent crime area, accept to buy higher crime area

The statistical findings are consistent with landlord risk factors as assessed by rentfaxpro except for crime which deserves a more detailed analysis. It appears that large landlord favored Goldilocks neighborhood when it comes to violent crime (neither to low as to lower rental yield nor too high), smaller landlords were more aggressive in buying violent hood housing stock.

(this trend is more visible with small landlords, bigger landlords avoid high violent crime)

Geography of Buy 2 Rent

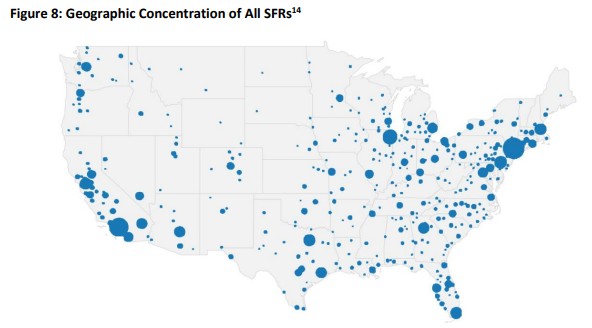

I gave an outline of US census trends back in December 2016. These two articles add some information. Here are were all the SFR are located in the US, we see large expensive population areas in California and NY:

The buy 2 rent homes are located in large cities with affordable rent:

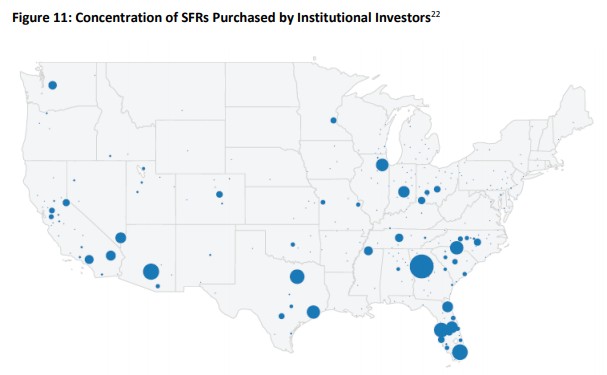

We see that institutional purchases concentrated on a few MSA were excess inventory became available due to foreclosures:

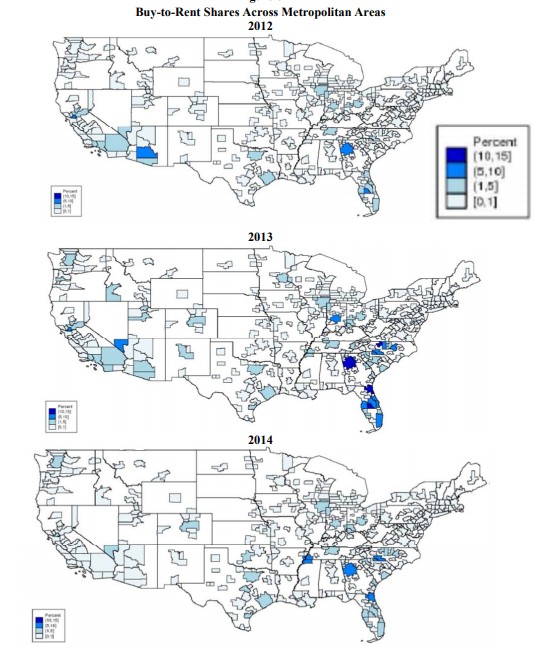

The large landlords purchase evolved as follow in 2012, 2013 and 2014:

This is illustrated in a map where we see the investor focus going from Arizona to Las Vegas to Atlanta:

Demographics and Affordability for Renters

A consequence of the crisis was to shift renter's age towards the 35-45 year old cohort which is more likely to need a SFR as they are raising children:

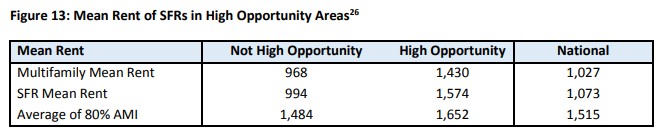

The affordability of rent compared to 60% of average median income (which defines poverty) is given by this table. An affordable house should be able to rent for $1100 per month unless it is in a more rural setting and its rent would be $900:

The median hides large disparities and rent and income in high opportunities areas go to $1500 median rent. In this case, housing affordability for the poor will be much more of a problem in high opportunity areas:

Conclusion

Large scale investment in SFR is a new asset class that contributes to between 1% and 5% of the rental market whereas traditional very small investors still own 88% of the rentals.

These new actors are highly price sensitive and have shown a capacity to move from one area to another as years went by. It is instructive to follow what these actors are doing.

| Tweet |

| |

| Click here to share this on BiggerPockets.com! | ||